Nearly 45% of all announced transactions came from the buyers that have completed more than 10 transactions over the last five years. This distribution, however, has migrated somewhat significantly for the most active buyers from a low of 32% in 2009 to a high of 52% in 2012. The majority of this increase has come from the PE backed buyers.

Tables D1-D5 provides additional detail on the most active acquirers from 2008-2012 by Buyer Type.

Of note were a number of “Top 100” type transactions in 2012 as reflected per the following:

- Arrowhead General Insurance was acquired by Brown & Brown

- Assured Partners acquired Dawson Companies

- Schiff Kreidler Shell was acquired by Gallagher.

- Payne Financial Group acquired Western States Insurance

- BB&T’s acquired Crump

- Digital Insurance was acquired by Fidelity National Financial.

Management guru Peter Drucker said “Dealmaking beats working. Dealmaking is exciting and fun and working is grubby. That’s why you have deals that make no sense.” In addition for the need to be cautious, disciplined and focused at the front end, the significant secondary challenge in the M&A world is making the acquisition work. The challenge, in part, is related to the task or work of integrating what has been acquired into the acquirer’s platform. The active acquirers have the experience and knowledge to effectively fold the acquired enterprise into their platform with a common culture and structure. Good practices make it perfect or at least nearly perfect.

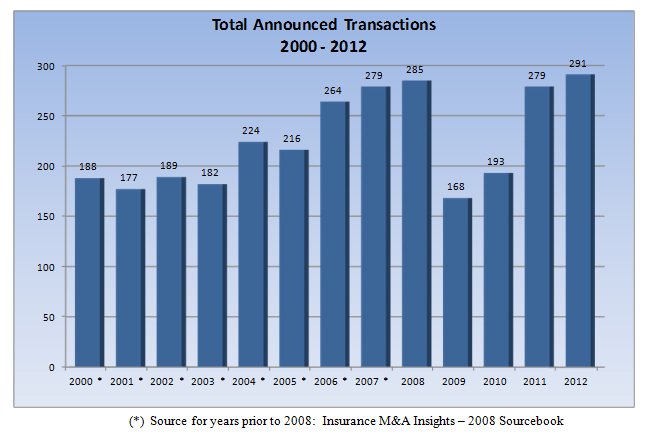

M&A activity will likely continue to be a major factor in the growth of the publicly traded brokers and the vehicle for investment opportunities by the PE backed buyers. It is not likely the record setting year of 2012 will be repeated in 2013 due to the lack of tax-driven seller motivation and the absorption of a large part of the available seller inventory. The buy-side atmosphere is strong and active and a portion of the 2012 momentum will likely continue into 2013 regardless of the current higher capital gains tax rates and the PPACA surtax for some. Sellers will adapt to the new tax rates, but it may take a little time for reality to set in.

The agent-broker industry is afflicted with a large “boomer” population with over one-third of all agency principals over the age of 55. The only realistic option for the majority of this group is to effect a sale transaction and thus it should provide a robust inventory of sale candidates for the buy-side group. In addition to the current crop of PE backed acquirers who will likely remain active, there could possibly be new PE backed firms to add to the already competitive atmosphere. Even with the record number of transactions in 2012, this is still a very fragmented industry with literally thousands of potential sellers and a large number of experienced well-positioned buyers that will be more than enough to create opportunities for those that are interested in joining the M&A fray.

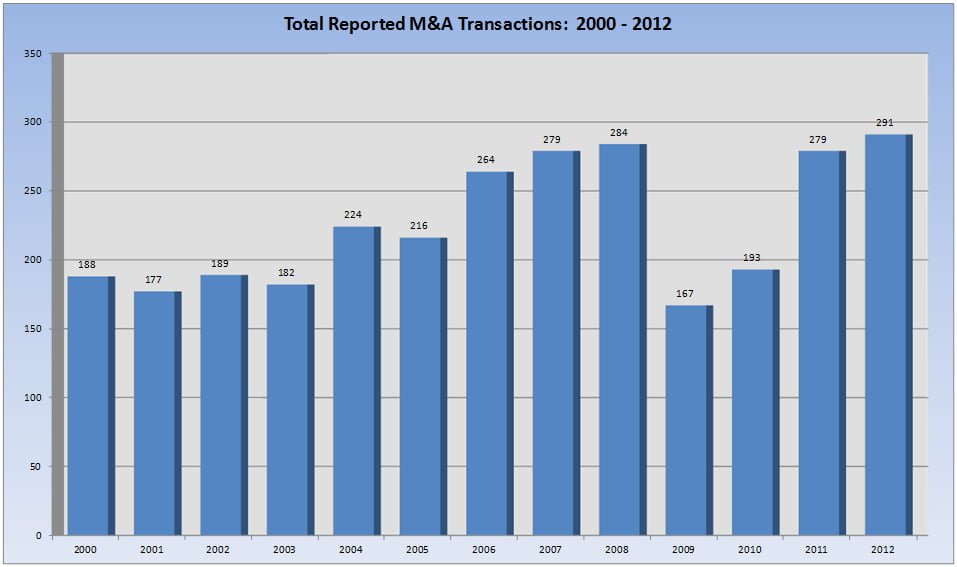

Table A – Summary of Reported Transactions by Year, 2000 thru 2012 – Click on image to enlarge

{simplepopup link=imagesix}

{/simplepopup} {simplepopup popup=false name=imagesix}

{/simplepopup}

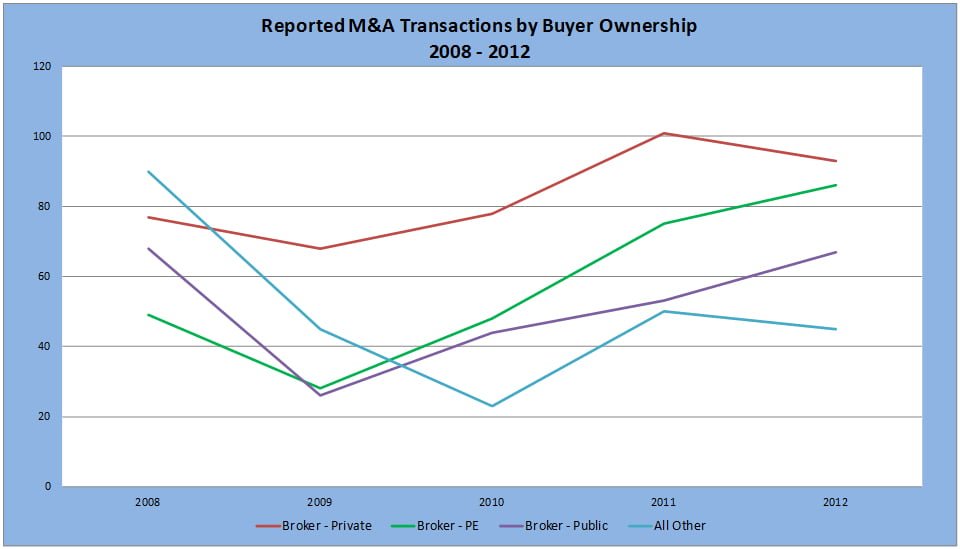

Table B – Summary of Reported Transactions by Buyer Ownership, 2008 thru 2012 – Click on image to enlarge

{simplepopup link=imageseven}

{/simplepopup} {simplepopup popup=false name=imageseven}

{/simplepopup}

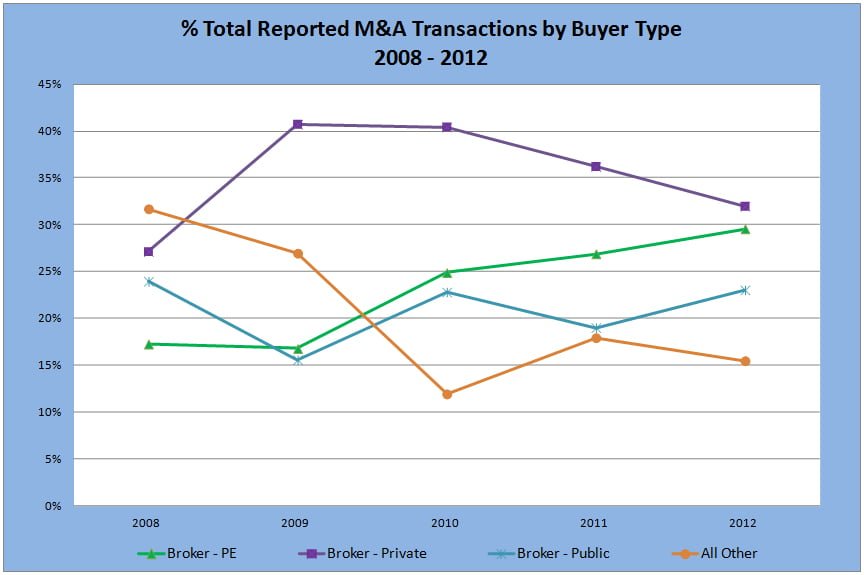

Table C – Summary of Reported Transactions by Buyer Ownership as a percentage of total transactions, 2008 thru 2012 – Click on image to enlarge

{simplepopup link=imageeight}

{/simplepopup} {simplepopup popup=false name=imageeight}

{/simplepopup}