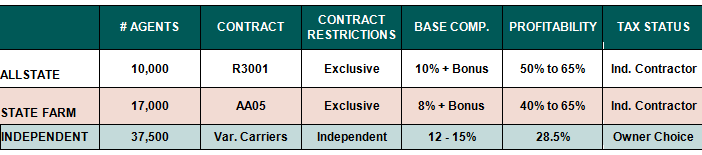

State Farm has essentially a “Defined Benefit Plan”, which they call the Annual Investment Payment Program (AIPP). There is a five-year vesting period, and then a percentage of your commission is returned to you in year seven, based on year six performance. These in arrears payments can be received for up to 20-years, so long as the individual remains an agent with State Farm during the entire time period. To me, this plan seems more like a bonus program as agents do not continue to receive additional contributions to their retirement from State Farm once they reach retirement age.

*The SURVEY was produced in the book “Maximizing Agency Value II,” produced by the Academy of Producer Insurance Studies.

Furthermore, State Farm Agents have no ability to sell their agency. This has resulted in many State Farm agents hanging on to their agencies well past their desired retirement age as they don’t have the opportunity to cash in their years of hard work for a lump sum transition sales price.

AUTHOR’S GRADES (GETTING OUT OF THE BUSINESS):

Allstate Insurance=A

State Farm=C

Independent=B

OTHER BUSINESS ASPECTS

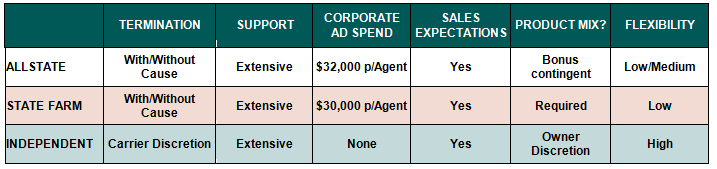

With all three business opportunities, carriers can terminate your contract with or without cause at any time. This means more risk for Allstate and State Farm Agents as they are both exclusive with a single carrier. In my experience, both State Farm and Allstate have been relatively consistent and conservative in using their rights to terminate agents.

All three business opportunities also come with Sales Expectations from their carrier(s). Bonus money and trips are at stake, along with the ability to stay with the carrier if base sales goals are not met for extended periods of time.

State Farm is a little unique with regards to the product mix as State Farm agents are not only expected to sell P&C / Life, but also Health Insurance, Mutual funds, and various banking products (through State Farm Bank), including auto loans, CD’s and saving accounts.

At the end of the day, Independent Agents possess the most freedom and flexibility to run their business how they see fit. Independent Agents can set their own hours of operation, can choose to sell or not sell any product, they staff in accordance with their own standards, market at their own discretion, and can move a customer to another carrier if it benefits themselves and their customer.

Support for the individual agent is very strong at both Allstate and State Farm. Not only does each of these two major carriers provide various levels of management whose sole job is to assist the agents, each of these major carriers spends millions of dollars in advertising each year without charging a franchise fee to the individual agent. Per the J. D. Power and Associates Insurance Information Institute, State Farm spent approximately $30,000 per agent in 2009, while Allstate Insurance spent approximately $32,000 per agent during the same time period. In contrast to Independent Agency owners who shoulder 100% of their advertising burden, the spending by Allstate and State Farm allows the individual agents to realize strong close rates in price proxy markets, while maintaining very profitable businesses.

“The views, opinions, positions or strategies expressed by the author and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.”