When it comes to getting into the business, Independent Agency Ownership gets an “A.” There are many companies available to assist a new agent with regards to signing with carriers, picking a location or purchasing an agency. Often, the only barrier to purchasing a positive cash-flowing Independent Agency is an absence of quality third-party bank financing.

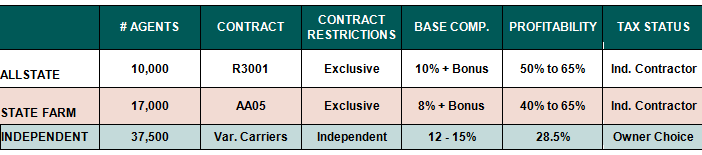

With Allstate, once you become an approved buyer, you can negotiate and purchase any agency you desire, or you have the option of opening a start-up agency at a location to be approved by Allstate. You sign the R3001 contract to be an agent prior to your first day open, so there is no internship or probationary period.

In my opinion, State Farm has some significant weaknesses with regard to getting into the business. Once you are an approved agent with State Farm, you cannot simply purchase a positive cash flowing agency. If a desirable agency comes available, you can put your name in a hat and then cross your fingers and hope State Farm selects you for this opportunity. It might even be the case that State Farm assigns you only a portion of the agency you desire, while giving a portion of the agency to other State Farm agents.

As a State Farm Agent, if you are selected to operate an existing agency or choose to a start-up, you must first complete a nine month internship. At the end of the intern process, you may be terminated; however, if you successfully complete the intern process, then you become a TICA (Term Independent Contractor Agreement) for a period of one year. This is essentially your probation period, where State Farm judges your performance as an agent. If you meet their standards, you become an actual State Farm Agent and sign an

AA05 contract, which signifies you are now an agent with State Farm. If you fail to meet expectations during your TICA period, State Farm reserves the right to terminate your TICA contract and not promote you to an agent. This can be very painful financially, as TICA agents have already signed a lease and often taken on debt to cover business operations, along with purchasing the necessary furniture, phone and other equipment to run their agency.

AUTHOR’S GRADES (GETTING IN THE BUSINESS):

Allstate Insurance=B+

State Farm=F

Independent=A

GETTING OUT OF THE BUSINESS

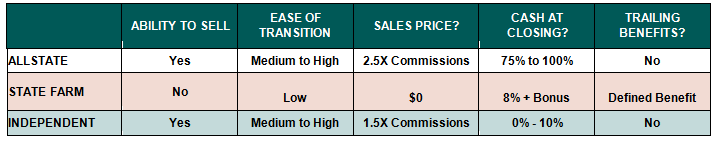

With Allstate Insurance, Agents are regularly selling their agencies for 2.0 to 2.5 times Commissions and are receiving the bulk of the sales price in cash at closing. The availability of bank financing is relatively strong for Allstate Agents, so true value is often transferred in the form of cash at closing from Buyer to Seller. As a worst-case liquidation value of the business, Allstate will purchase the agency back from the agency owner for 1.5 times qualified commissions (Termination Payment Provision or TPP Value). Only 90 days’ notice is required for agents to put their agency back to Allstate. This represents a very unique base floor value, which may often allow an agent to get cash for their business in excess of what an Independent Agent may receive without any hassle of finding a buyer or going through the sales process.

“The views, opinions, positions or strategies expressed by the author and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.”