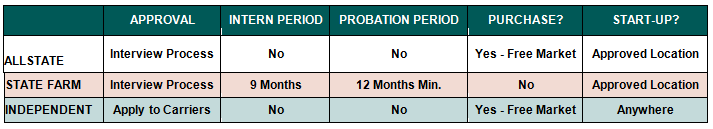

Let’s start by taking a quick look at some basic Background information on these three opportunities. In each section, I will give my own personal grade (A – F) based on how the opportunities did or did not meet my criteria listed above:

OVERVIEW:

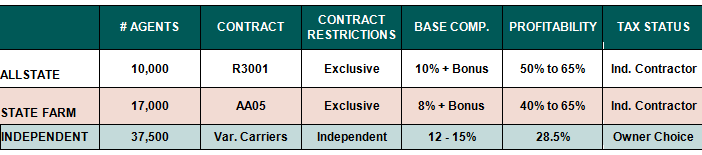

Essentially an Owner must ask the ultimate question any business owner must ask – “How much money will I make?” The above chart shows “Profitability” which represents the amount of discretionary cash flow available to the owner after all necessary operating expenses to run the business have been paid (not including debt service).

With regard to business profitability, Allstate and State Farm have a significant edge on Independent Agency Owners. This is due in large part to the staffing costs of an Independent agency typically running at just over 50% of revenues.

For me, Allstate is superior to State Farm with regards to commission income and profitability, and it comes in the form of a more consistent Base Commission Percentage. Allstate Agents currently get a base commission rate of 10%, which provides a higher degree of income stability, and subsequently a more consistent profit margin over those State Farm Agents who receive a base commission of 8%.

When Allstate modifies its base commission to 9% starting in 2013, this will serve to bring more instability to the income and subsequently the profitability received by Allstate Agency Owners, as a greater portion of income will be shifted from fixed compensation to contingent compensation. On the other hand, instability is not always bad as some agents will be surprised to receive more income than they previously expected. At the end of the day, I feel the majority of Allstate Agency Owners will adapt nicely to a 9% base commission rate as this change in compensation will likely not result in any wild swings in income that would affect Allstate Agents’ ability to efficiently operate their business.

With regard to Contract Restrictions, Independent Agency Owners have the most flexibility to shop a client’s business within their various suite of carriers. Allstate and State Farm agents are exclusive and must live with the current price of their suite of products as set by their exclusive carrier.

***Independent Agency Owner’s Profit listed above was taken from the Insurance Agents & Brokers of America annual Best Practice Study, which shows the average adjusted profit for Independent Agents with Revenues under $1,250,000 to be 28.5%.

AUTHOR’S GRADES (OVERVIEW):

Allstate Insurance=B+

State Farm=B

Independent=C

GETTING IN THE BUSINESS

“The views, opinions, positions or strategies expressed by the author and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.”