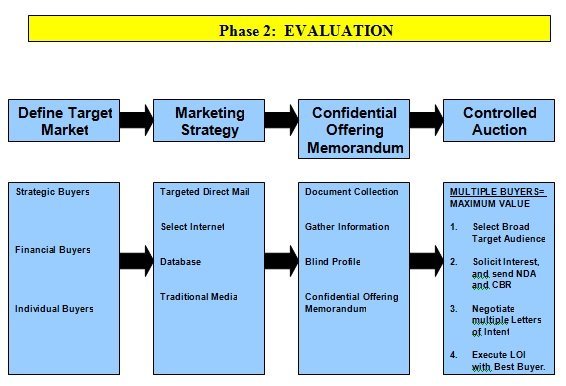

CONFIDENTIAL OFFERING MEMORANDUM

The Confidential Offering Memorandum (“COM”) is a complete description of the business, its financials, its structure and history, and description of all aspects of the business. This document is only sent to approved buyer prospects that have signed a Non-Disclosure Agreement. The COM is similar to a 10K report that is filed by publically traded companies with the Securities and Exchange Commission[2]. The first step in developing the Confidential Offering Memorandum is to gather all of the documents and information that will be needed. The next step is to put together a first draft of the Confidential Offering Memorandum, which will include all of the information contained within the documents, summarized in charts and graphs, with properly footnoted sources of information. The COM can be anywhere from 15 – 75 pages long. Once the Confidential Offering Memorandum has been edited and approved, it is professionally prepared for distribution to pre-screened buyers. The final stage of the evaluation phase is to create a controlled auction.

THE CONTROLLED AUCTION

The Controlled Auction is the most consistently effective process to maximize the price and terms of the sale of a business. A maxim in the mergers and acquisition industry is that “one buyer is no buyer.” The Controlled Auction is a process where a business is widely marketed to a specific target audience to create an environment where there are multiple buyers bidding for the business, with each buyer knowing that there are other buyers, but without the terms or price of the other offers being disclosed. This process will elicit the best price and terms from several buyers.

Active Solicitation of Interest: The first step in creating a Controlled Auction is to execute your marketing strategy. The blind profile will be sent to the target audience, including strategic, financial and individual buyers. Ideally, the target audience should have a number of qualified, strategic buyers.

Price and Terms: The Controlled Auction is designed to allow the market to generate the price and terms of the offers. Qualified buyers are screened to ensure that they have the financial wherewithal and sufficient interest and experience to consummate the purchase, and are asked to submit their best proposals[3]. The COM will contain all of the necessary information that a qualified buyer will need to develop a proposal with a price and terms that reflect the value of the firm to that buyer. Because the qualified buyer knows that there are other strategic buyers, and that the firm has been prepared and properly marketed to those buyers, it is in his interest to submit his best offer up front rather than “starting low”.[4]

Principal meetings: After qualified buyers have signed Non-Disclosure Agreements, had an opportunity to review the Confidential Offering Memorandum, meetings with the firm owner(s) will be arranged. These meetings are used by both parties to gain an understanding of each other’s goals, motivations, and character. Business Owners and prospective buyers will want to have confidence in the other person or firm that they are considering doing business with.

Letters of Intent: During the first 30 – 90 days of the Controlled Auction process, qualified buyers are requested to send a signed Letter of Intent (“LOI”) that outlines the price and terms of their offer. The LOI is a document that spells out what assets are being purchased (or shares of the company in the case of a stock sale), the purchase price, and the terms of the offer. The Controlled Auction process may proceed quickly once the first LOI is received. All qualified buyers that have signed Non-Disclosure Agreements will be informed that a LOI has been received and that a decision must be reached prior to its expiration, and an expected timeline will be spelled out. These qualified buyers will be requested to submit their best offer through a signed LOI prior to the expiration date. In most scenarios, this will result in multiple qualified buyers submitting their best offers.

Buyer Selection: Once several qualified buyers have submitted their best offers through a signed LOI, the Owner will meet with the appropriate advisors on the team to discuss each LOI and the terms that are involved. Once all requested information has been gathered and considered, the Owner will be in a position to select the best offer. The selected LOI is then signed, and the selected buyer is notified of the acceptance. The selected buyer is then informed of the process and timeline moving forward. The qualified buyers that were not selected will also be notified and informed that they may have another opportunity to acquire the agency in the event that the selected buyer does not consummate the transaction for any reason.

Next month, we will discuss the conclusion of the M&A process, including due diligence, purchase agreements, valuation and deal structure, employment agreements and non-competition agreements.

Mr. Hughes serves as Director of Insurance Distribution for Merger & Acquisition Services, specializing on insurance agencies, MGAs, MGUs, E&S agencies, wholesalers, and ancillary insurance businesses. He may be reached at chughes@maservices.comor 860.748.1910.

[2] For examples of 10K reports, and what a Confidential Offering Memorandum may look like, see www.sec.gov/edgar , and select a publically traded company such as HIG or AON.

[3] All qualified buyers must sign a Non-Disclosure Agreement (“NDA”) to obtain a Confidential Offering Memorandum.

[4] Marketing a firm without price and terms works best with middle market firms with discretionary earnings or EBITDA of $500,000 or greater. For smaller firms or books of business of less than $500,000, the firm may be marketed with a specific price and preferred terms.