Insurers Continue Increases for All Lines of Business

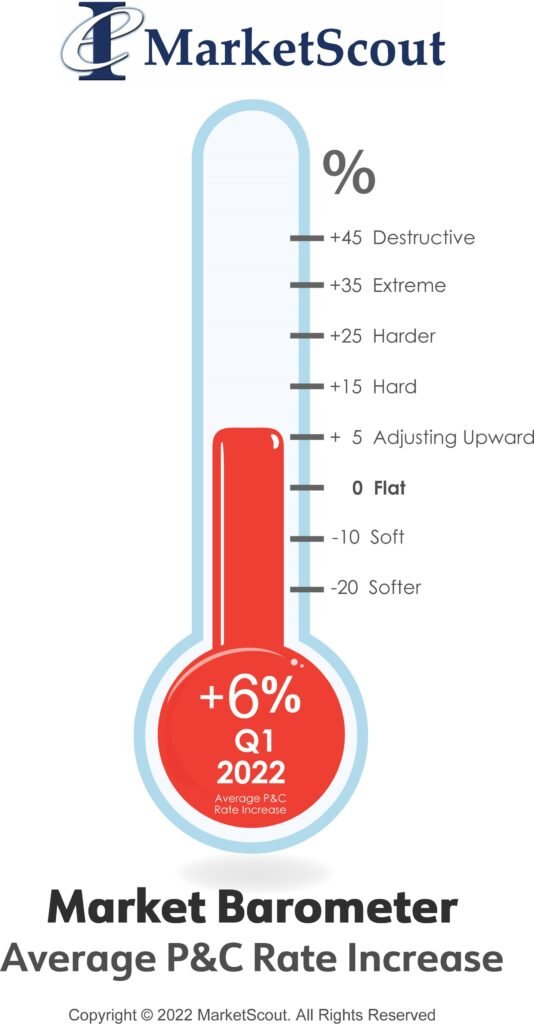

As losses mount, insurance companies and their reinsurers continue to assess rate increases across all lines of coverage and industry groups. The composite rate increase for the first quarter of 2022 was 6 percent as compared to 5.8 percent for the fourth quarter of 2021.

“Rates in January and February were consistent with what was reflected in the last quarter of 2021,” commented Richard Kerr, CEO of MarketScout. “However, rates did start to move up even more in March 2022, which could be the beginning of stronger increases for the next several quarters.”

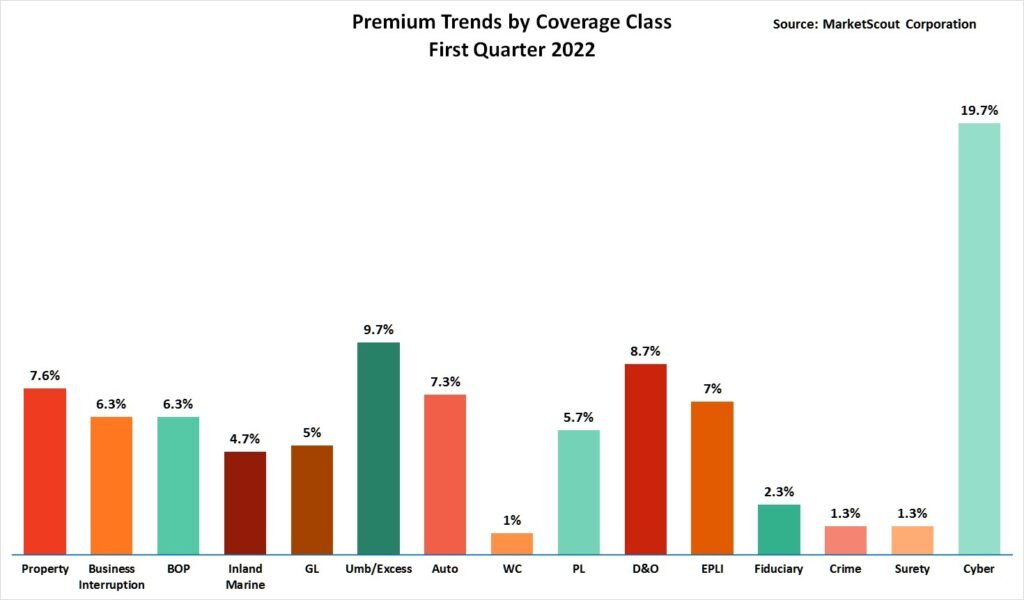

When measuring rates by coverage classifications, rates were most aggressive in the first quarter 2022 for cyber, umbrella and D&O at plus 19.7 percent, 9.7 percent and 8.7 percent respectively.

By industry classification, transportation and habitational rates increased the most at plus 10.3 percent and 8 percent respectively.

Small and medium size account rates moved up to 5.3 percent and 6.3 percent respectively. Rates for large and jumbo accounts were steady at an increase of 6.7 percent.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the first quarter 2022 rates by coverage, industry class and account size is set forth below.

| By Coverage Class | |

| Commercial Property | Up 7.6% |

| Business Interruption | Up 6.3% |

| BOP | Up 6.3% |

| Inland Marine | Up 4.7% |

| General Liability | Up 5% |

| Umbrella/Excess | Up 9.7% |

| Commercial Auto | Up 7.3% |

| Workers’ Compensation | Up 1% |

| Professional Liability | Up 5.7% |

| D&O Liability | Up 8.7% |

| EPLI | Up 7% |

| Fiduciary | Up 2.3% |

| Crime | Up 1.3% |

| Surety | Up 1.3% |

| Cyber | Up 19.7% |