Homeowners and Personal Article Rates Increasing

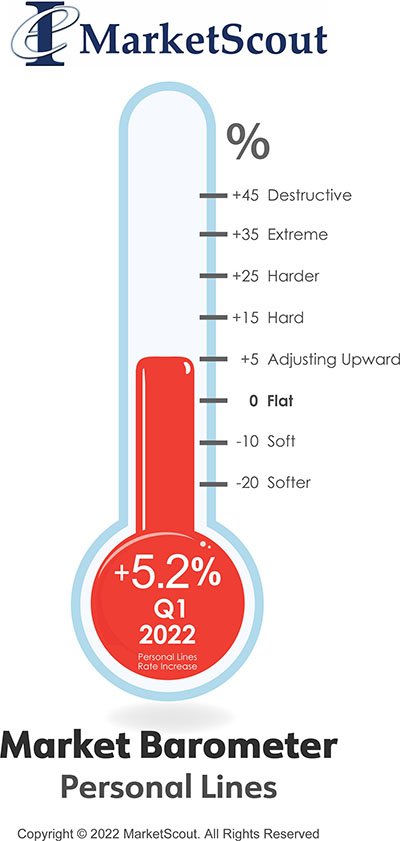

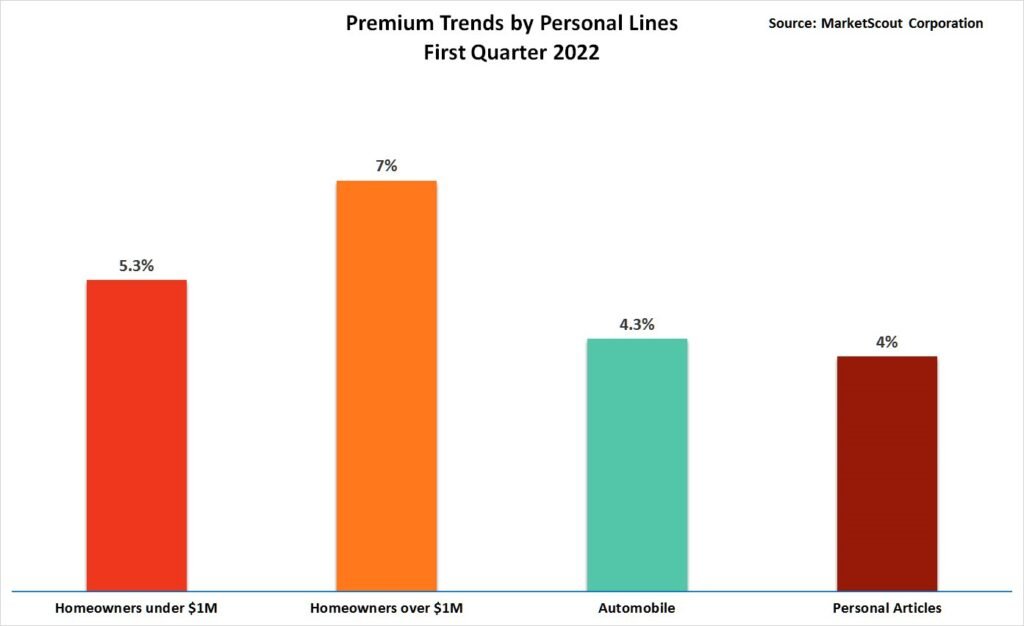

Rates for almost all homeowners across the US increased in the first quarter of 2022, regardless of the geographic location or value of the home. For homes below $1,000,000 in value, rate increases of 5.3 percent were assessed in the first quarter of 2022 as compared to just 3.7 percent at the end of 2021. For the large homes over $1,000,000 in value, rates also increased from plus 6.3 percent at end of 2021 to plus 7 percent in the first quarter of 2022.

Personal articles rates are increasing as well with an increase from plus 3 percent in Q4 2021 to plus 4 percent in Q1 2022.

Personal auto rates were relatively stable at plus 4.3 percent in Q1 2022, just a small increase from Q4 2021.

Richard Kerr, CEO of MarketScout outlined, “We expect homeowners rates across the US to continue to increase. What used to be considered relatively benign catastrophe prone areas of the US are now experiencing more and more claims. Further, several major insurers are dramatically cutting back their appetite for tough to place homes. This will impact the availability of coverage and result in significant rate increases or coverage restrictions for many homeowners whose insurer will issue a notice of non-renewal. MGAs and brokers are scrambling for capacity. The exit by these insurers will accelerate the formation of new capacity providers and insurers. In the meantime, rates are going to increase considerably for the tough to place homes; perhaps as much as 35 percent.”

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the first quarter 2022 personal lines rates is set forth below.

| Personal Lines | |

| Homeowners under $1,000,000 value | Up 5.3% |

| Homeowners over $1,000,000 value | Up 7% |

| Automobile | Up 4.3% |

| Personal Articles | Up 4% |

About MarketScout

Founded in 2000, MarketScout is an insurance distribution and underwriting company headquartered in Dallas, Texas. The company is a Lloyd’s Coverholder and MGA for US insurers with specialty expertise in workers’ compensation, private client solutions, energy, healthcare, fine art, equine, jewelry, professional liability, and many specialty programs. The company owns and operates the MarketScout Exchange, as well as over 40 other online and traditional underwriting and distribution venues. MarketScout is the founder of the Council for Insuring Private Clients (CIPC) and administers the Certified Personal Risk Manager (CPRM) designation in partnership with The National Alliance for Insurance Education & Research. MarketScout is the only insurance organization to receive The National Alliance’s exclusive partnership and endorsement. The company founded the Entrepreneurial Insurance Alliance (EIA) in 2007 to support insurance entrepreneurs and in 2017 founded the MarketScout InsurTech (MIT) venture fund. In January 2018, it launched an Incubator to accelerate start-up MGAs and assume operational functions for existing MGAs and insurers. MarketScout’s company culture and sense of community encourages growth, learning and collaboration. The company has been named as one of the Best Places to Work in Insurance by Business Insurance for ten consecutive years from 2012 to 2021. The company has offices in Arkansas, Florida, Illinois, Nebraska, Pennsylvania, South Carolina, Tennessee, Texas, and Washington, DC. California license #0D60423.

Source: MarketScout

“Some of the statements in this third party article may be forward-looking statements and perhaps even inaccurate statements. AgencyEquity or Strategic Agencies LLC does not make any representation or warranty, express or implied, as to the accuracy, completeness, or updated status of such statements. Therefore, in no case whatsoever will AgencyEquity or Strategic Agencies LLC be liable to anyone for any decision made or action taken in conjunction with the information and/or statements in this press release or for any related damages.”