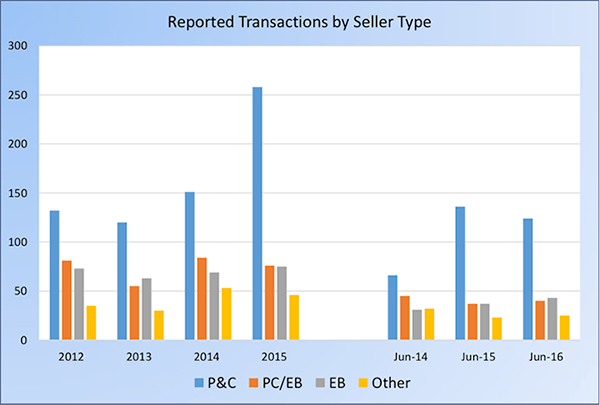

Examining the raw acquisition numbers among seller groups, however, provides a broader perspective. While P&C/EB and EB agencies now represent a far lower percentage of transactions than they did several years ago, the number of acquisitions involving these types of agencies has remained relatively stable. However, because of the significant expansion in the number of the P&C transactions, the percentages as shown in the table above have moved accordingly.

The number of P&C agencies being acquired has exploded over the past couple years, nearly doubling between 2012 and 2015. First-half 2016 acquisition numbers in this group are down slightly from the same period a year ago, but they are still nearly double 2014’s first-half total.

Among the sellers during the first half, there were not any that ranked among the top 100 agencies during 2015. From 2010 through 2015, a total of 25 top-100 firms agreed to sell, with between two and eight of those firms acquired annually.

Summary

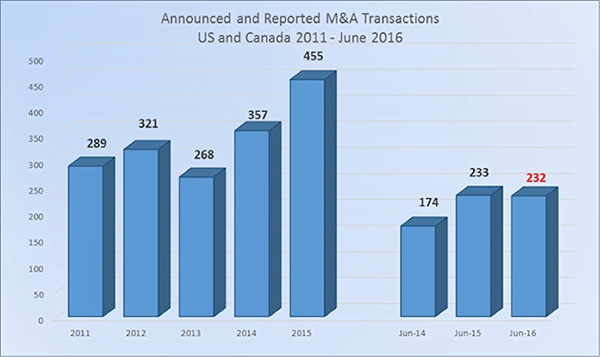

Although M&A activity during the first half of 2016 was essentially flat compared with last year’s first half, it remains at a near-record-high level. Barring any unforeseen economic, financial or political developments that change the underlying market, we expect that the current trends driving M&A activity will continue.

The U.S. economy continues to improve. While insurance prices in the P&C segment continue to soften according to the Council of Insurance Agents & Brokers’ most recent market survey, the deterioration of insurance pricing is not significant and is being offset to some degree by growth in exposures and coverages. Interest rates remain at historic lows, minimizing the cost of borrowed funds used for acquisitions, especially with the PE-backed group.

Private equity capital, which has been behind the preponderance of agency acquisitions over the past several years, is still abundant. Investors continue to find the U.S. insurance distribution market opportunistic for an adequate return on investment. To ensure that they are the successful suitors of brokerages expected to deliver attractive returns, PE-backed buyers have been willing to value agencies at or near historical levels.

At some point, however, agency valuations and M&A activity likely will return to more sustainable levels. Whether we are beginning to see that transition with the results through June, or just a minor aberration in the timing of transactions is unclear at this point. Still, as we have commented previously, if you are an agency owner pondering about the best time to put your agency in play, strongly consider taking action sooner than later. Relative to historical trends, interest from buyers is high and agency valuations are near their peak, so now may be the time. If you are a buyer, be cautious about trying to compete with the high multiples in the marketplace. A premium price paid for acquisition can have significant adverse implications on the long-term viability of your agency if the acquired entity does not perform according to expectations and you do not have the capital base to absorb the shortfalls.

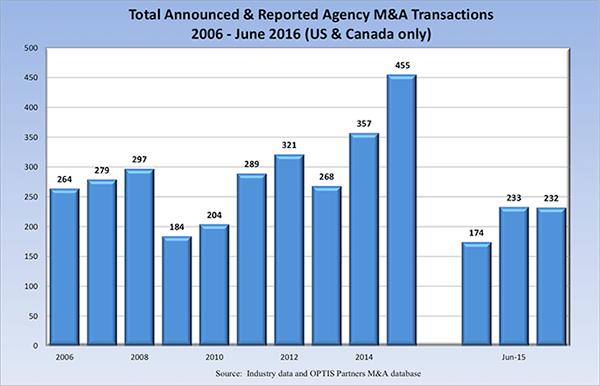

Table A — Summary of Announced Transactions 2006 – June 2016