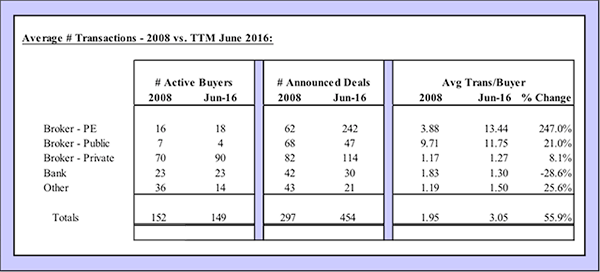

As shown in the chart below based on activity for 2008 vs. the TTM period ending June, 2016, the average number of transactions per buyer varies widely across the different buyer groups, and has become much more concentrated since 2008.

The PE-backed firms announced an average of over 13 transactions over the past 12 months, up from just under four deals in 2008, and well in excess of the average number of acquisitions by the privately owned group of buyers.

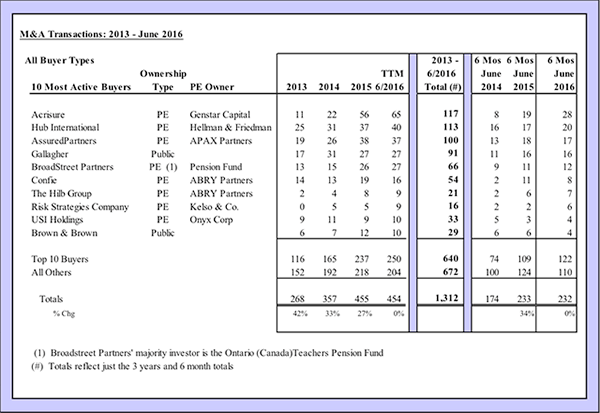

Most-active individual buyers

Among the 10-most active buyers, as ranked by six-month totals through June, seven are PE-backed brokers—including the three most-active firms. Acrisure reported the most transactions—28, nine more than during the same period last year. Hub International completed 20 transactions—three more than last year, and AssuredPartners announced 17—just one fewer than a year ago. Publicly-traded Gallagher was the fourth most-active buyer with 16 deals—the same number it announced during the first half last year. Rounding out the top five buyers was PE-backed BroadStreet Partners with 12 deals—one more than a year ago. Four of the five most-active buyers—the exception being AssuredPartners—announced as many or more deals over the TTM period as they did during calendar 2015.

The remaining buyers on the 2016 10 most-active list, like the other 88 buyers during the first half, announced transactions numbering in the single digits. Eight buyers announced five or more deals this year compared to 11 firms during last year’s first half while 70 brokers reported only one acquisition each during the first six months this year, down from 77 during the Jan-Jun period in 2015, but up from 55 for the Jul-Dec period last year.

Among the 98 unique buyers during the first half of 2016, a few were more active than they were during the same period last year. Those reporting the largest increases were Acrisure, with nine more deals in 2016, Risk Strategies, four, and Digital Insurance and HUB, three more deals each. NFP had the largest decrease, with five fewer deals in 2016, followed by Integro, with four fewer, and Patriot National and Confie, both with three less announced transactions.

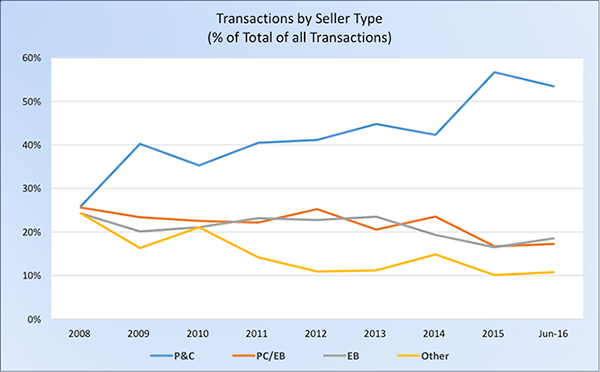

Seller Groups

Eight years ago, all four seller groups—Property and Casualty firms, P&C/Employee Benefits firms, EB firms, and Others, such as Wholesalers, Managing General Agents and Managing General Underwriters—each accounted for roughly one-quarter of all acquisitions. Since 2009, P&C firms have emerged as the dominant seller group. In 2015, that group broke the 50% threshold, accounting for 57% of acquisitions. That figure slipped somewhat during the first six months this year but still exceeded half of all transactions at 53%.