PE-backed brokers still driving M&A activity

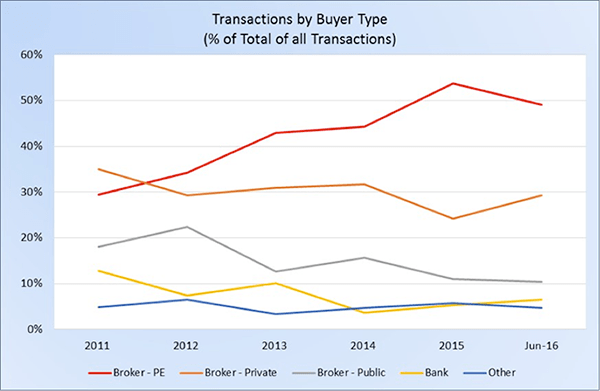

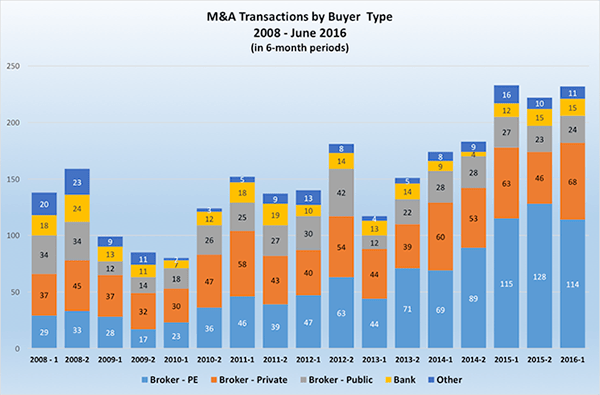

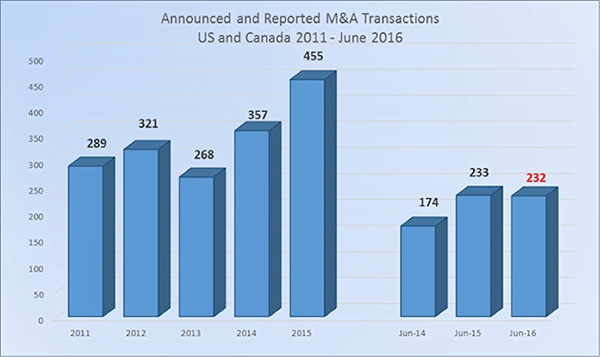

As they have every year since 2012, brokers backed by private-equity capital were by far the most-active group of buyers during the first half this year with 114 of the 232 announced deals. While that activity represents a dip to 49% of all transactions compared to nearly 58% during 2015’s second half, it is on par with last year’s first-half activity.

Privately-owned brokers were the second-most active group of buyers with 68 deals—or 29%, up from 24% during the year-earlier period. Publicly-traded brokers announced 24 deals, or a little more than 10% of the total, down three deals from last year’s first-half count.

Financial institutions continue to account for less than 10% of M&A activity, a level they fell to in 2012, but the first half of 2016 marks the third consecutive six-month period of sustained or growing activity for the group. Banks announced 15 transactions, three more deals than during last year’s first half and equal to the total during last year’s second half. During the full year in 2011, financial institutions announced 37 deals, the only period other than 2008 when banks completed more than 30 deals. Insurance companies and other buyers also were less active the first half this year compared to the first six months of 2015 and remain a relatively inactive group.

In 2008, PE-backed brokers were only the third-most active group of buyers, with privately-held brokers ranking first and publicly-traded firms second. But after the financial crisis developed in September 2008, private equity focus on the insurance distribution sector has grown dramatically. From 2009 through 2011, PE-backed brokers were the second-most active group of buyers, and then pulled ahead of all other types of buyers in 2012.

The second half of 2015 marked the first time any group of buyers accounted for 50% or more of all transactions. Indeed, PE-backed brokers were so active during the second half last year—representing the buyers in nearly 58% of all deals—that they also accounted for more than half—54%—of the total number of deals for the full year. While PE-backed brokers’ M&A activity experienced a modest drop-off from its record level during the second half of 2015 level, the investment environment suggests this group of buyers will continue to view insurance distribution as a solid return-on-investment opportunity.

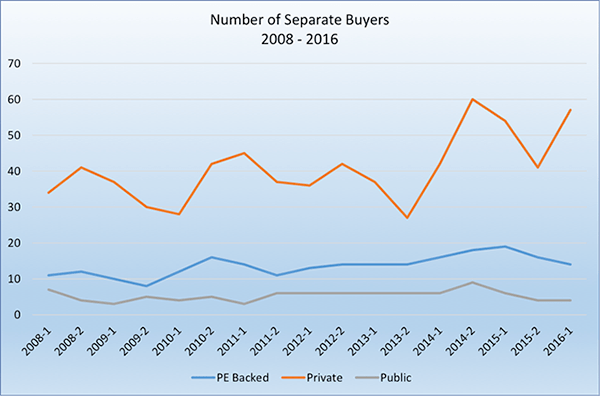

Looking at the trend of the number of buyers for the three most active buyer groups (Privately owned, PE-backed and Publicly traded), the chart below illustrates the number of buyers from each of the three groups for each semi-annual period from 2008:

As they have been since we started tracking M&A activity, privately-owned brokers have the largest number of active participants, finishing with 57 firms announcing deals through June, 2016. But those buyers announced only 68 deals—or slightly more than one acquisition per firm on average.