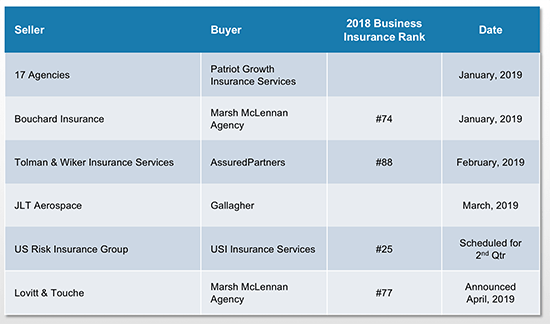

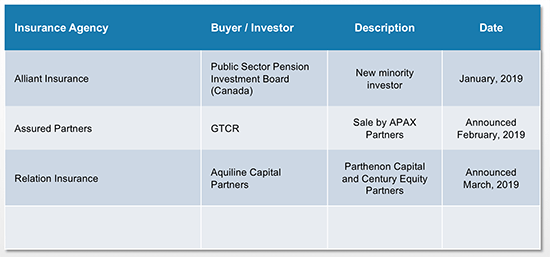

Significant 2019 Broker Transactions

Private Equity-backed Ownership Changes

Other Observations and Comments

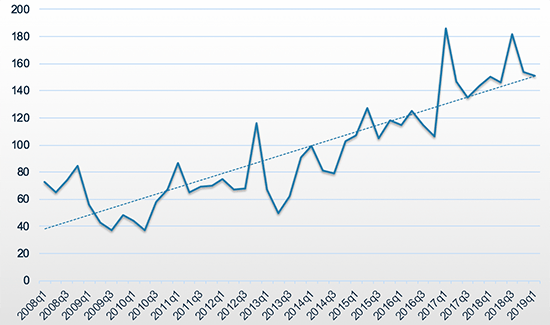

- No indications of any changes in Buyer and Seller behavior in the market, both in terms of appetite for transactions and valuations of agencies for sale

- Individual quarterly totals can fluctuate dramatically from one period to the next and are not necessarily indicative of the overall M&A activity level

- Only 57 unique buyers in 2019, the lowest number in any 1st Quarter since 2014

- Acquisitions in Canada have increased from 1-2% of the total 10 years ago to now representing 6-8%

Explanation and sources of data:

Data is for U.S. and Canadian transactions in the insurance distribution sector for both retail and wholesale producers, including managing general agencies/managing general underwriters (MGA/MGU). These agencies and brokers provide property/casualty insurance, employee benefits, or any combination thereof.

Data for reported and announced transactions have been obtained from various sources, including press releases, trade press articles, company websites and direct communications with buyers.

————————————————————————————————————————————–

OPTIS Partners, LLC is a boutique investment banking and consulting firm with offices in Chicago, focused exclusively in the insurance distribution marketplace. Optis Partners provides buy-side and sell-side M&A services, ownership succession planning, fair market valuation and related consulting services. OPTIS was ranked as the fifth most active agent-broker M&A advisory firm in 2014 and 2015 by SNL Financial.

This analysis was prepared by Timothy J. Cunningham, managing director, and Daniel P. Menzer, senior partner.

To learn more about OPTIS Partners LLC, please visit their website.