2021 Marks Tenth Consecutive Year of Rate Increases

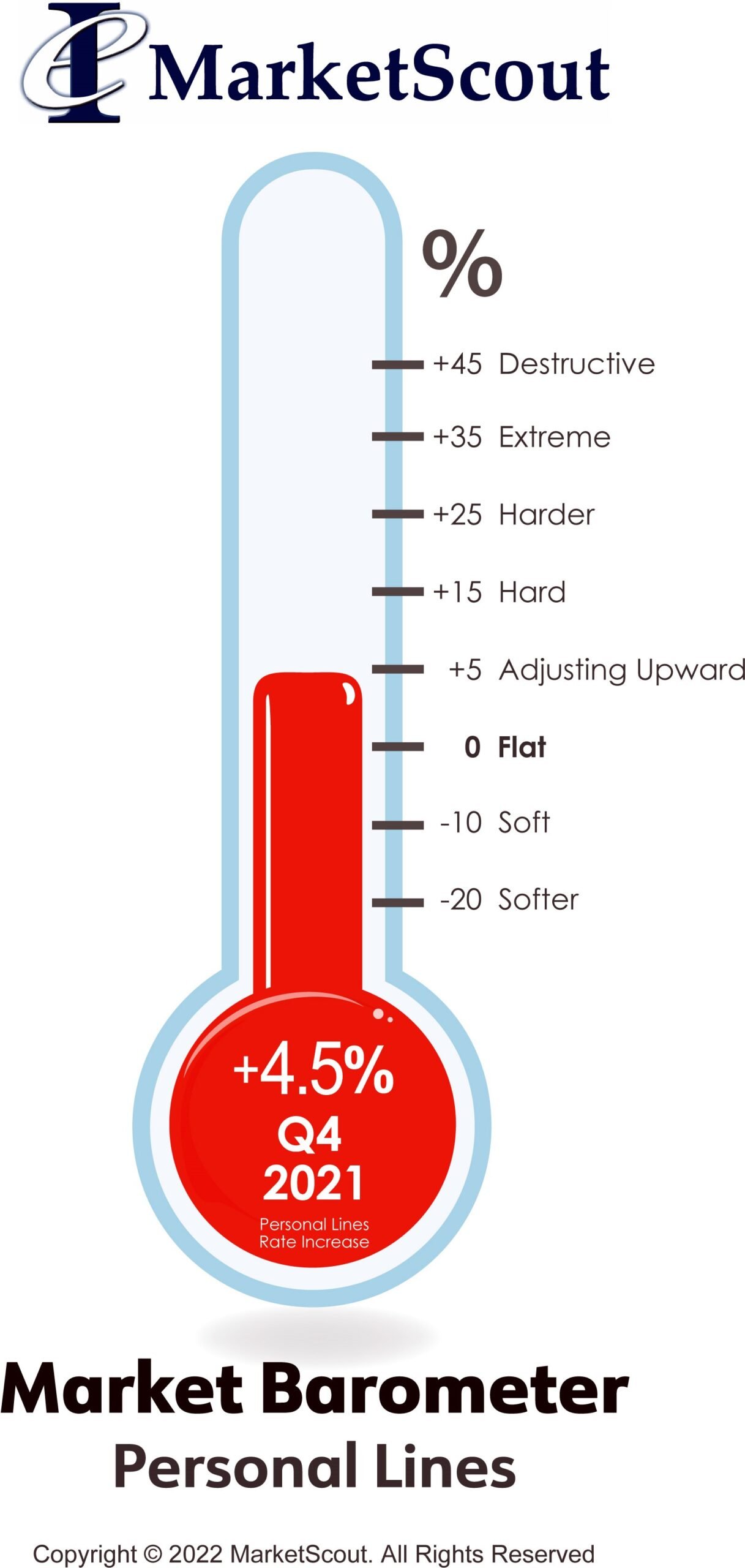

Personal lines rates were up 4.25 percent in the fourth quarter of 2021. Homeowners, personal articles, and auto rates all moderated slightly from the third to the fourth quarter 2021.

Richard Kerr, CEO of MarketScout commented, “The composite national personal lines market continues to steadily adjust rates as necessary without year-over-year massive rate increases. However, for CAT exposed properties, rate increases can be dramatic; as much as twenty-five to forty percent in areas such as the wildfire corridors of California or Southern portions of Florida.”

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

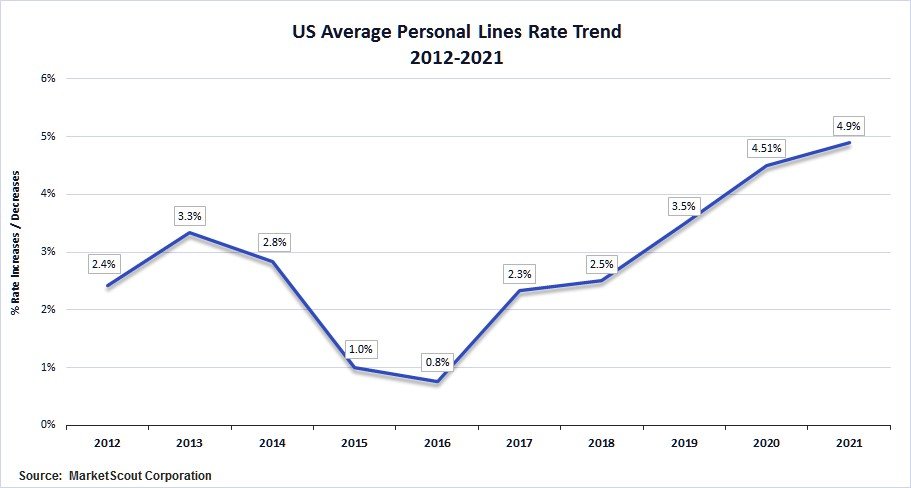

Summary of annual personal lines average rate increases from 2012 to 2021.

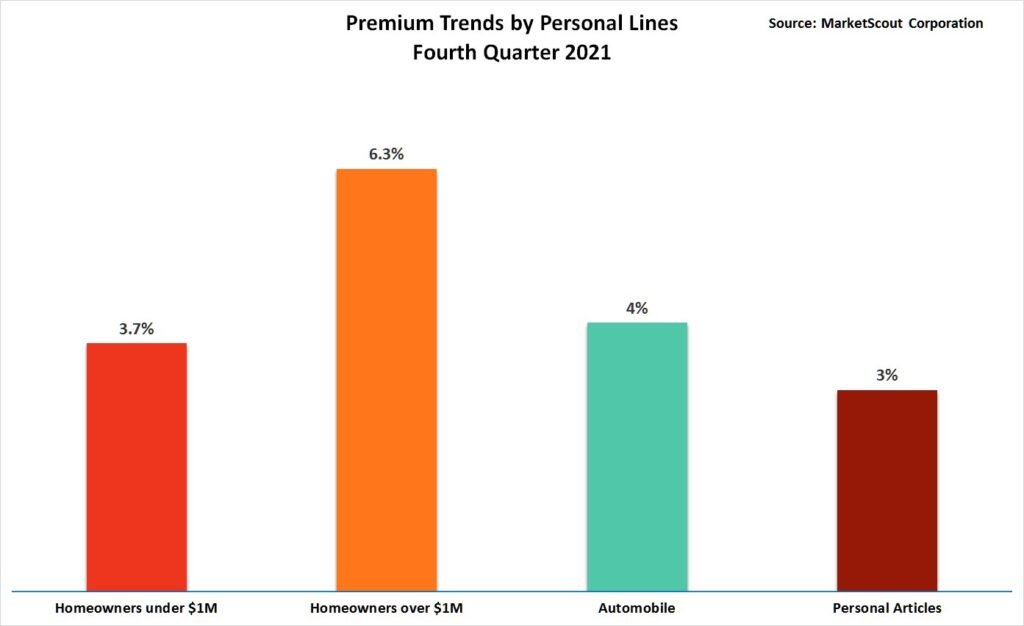

A summary of the fourth quarter 2021 personal lines rates is set forth below.

| Personal Lines | |

| Homeowners under $1,000,000 value | Up 3.7% |

| Homeowners over $1,000,000 value | Up 6.3% |

| Automobile | Up 4% |

| Personal Articles | Up 3% |

Source: MarketScout

“Some of the statements in this third party article may be forward-looking statements and perhaps even inaccurate statements. AgencyEquity or Strategic Agencies LLC does not make any representation or warranty, express or implied, as to the accuracy, completeness, or updated status of such statements. Therefore, in no case whatsoever will AgencyEquity or Strategic Agencies LLC be liable to anyone for any decision made or action taken in conjunction with the information and/or statements in this press release or for any related damages.”