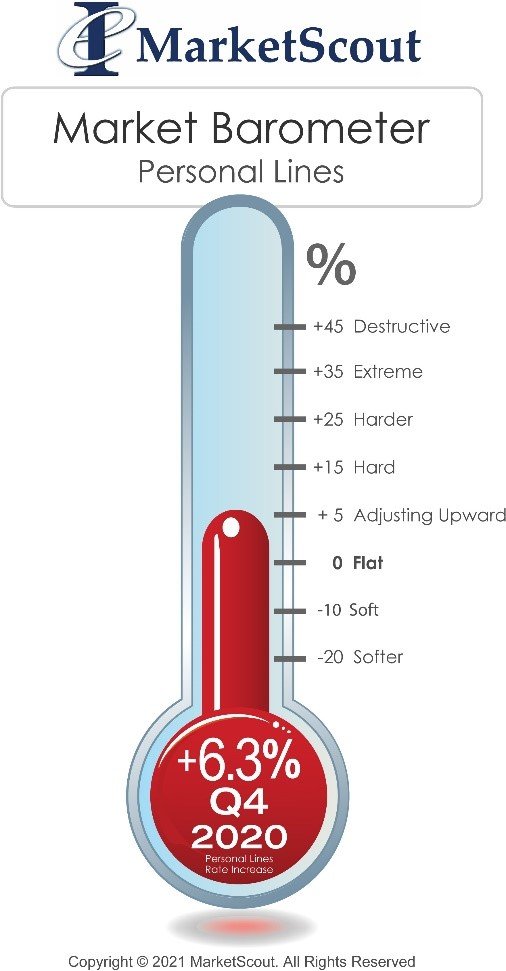

US Personal Lines Rates Up 6.3% in Fourth Quarter 2020

Large homes assessed biggest rate increase

The composite rate for personal lines was up 6.3 percent in the fourth quarter of 2020, reflecting the market’s rate acceleration. In fact, homeowners with properties valued over $1,000,000 paid average rate increases of 8.2 percent clearly signaling ongoing price increases for large homes.

Richard Kerr, CEO of MarketScout profiled market conditions by noting, “Rates are up modestly across all sectors of personal insurance with high net worth homeowners rates up the most. Wealthy clients are buying more homes as an escape and if they are not buying something new, they are renovating the ones they already own. Homeowners lucky enough to own properties with the home replacement cost in excess of $1,000,000 have borne the brunt of most of the rate increases, especially in the fourth quarter 2020. For those homeowners fortunate enough to own a beach or mountain home, increases are more severe. Homes in brush fire areas of California or hurricane prone sections of Florida, are assessed rate increases as high as 20 to 30 percent. The only way to offset big rate increases is to shop your insurance and limit coverage or raise deductibles”

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

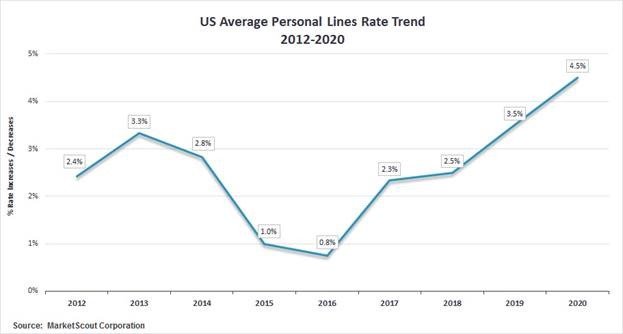

Summary of annual personal lines average rate increases from 2012 to 2020.

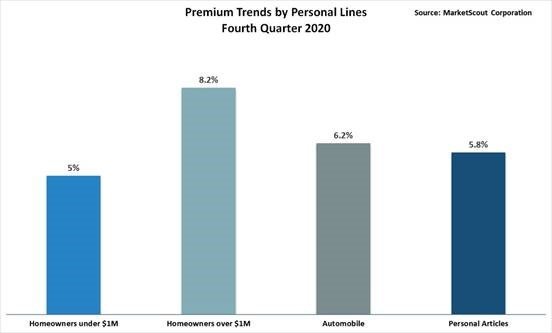

A summary of the fourth quarter 2020 personal lines rates is set forth below.

| Personal Lines | |

| Homeowners under $1,000,000 value | Up 5% |

| Homeowners over $1,000,000 value | Up 8.2% |

| Automobile | Up 6.2% |

| Personal Articles | Up 5.8% |