Insurers confident in their pricing strategy

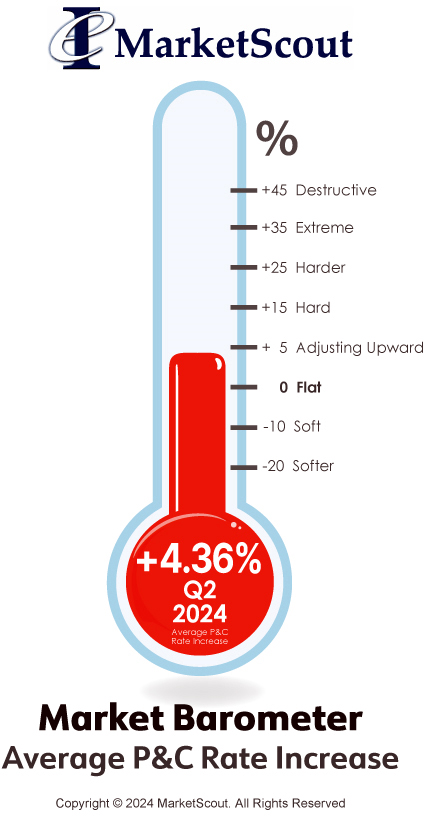

The composite rate for US property and casualty insurance increased slightly from 3.9% in the first quarter to 4.36% in the second quarter of 2024.

“Insurers are comfortable with their pricing, and as a result, there was no significant movement in rates for any coverage or industry group,” said Richard Kerr, CEO of Novatae Risk Group. “We are at the beginning of hurricane and wildfire season, so property rates could change based on these potentially catastrophic events. But for now, all is steady.” added Kerr.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the second quarter 2024 rates by coverage, cyber liability, industry class and account size is set forth below.

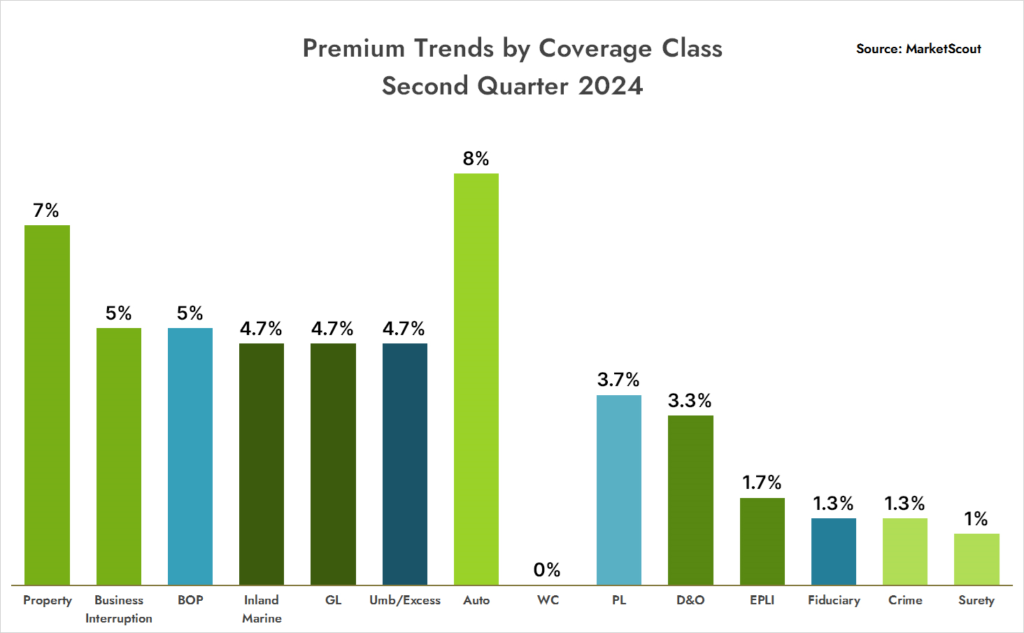

| By Coverage Class | |

| Commercial Property | Up 7% |

| Business Interruption | Up 5% |

| BOP | Up 5% |

| Inland Marine | Up 4.7% |

| General Liability | Up 4.7% |

| Umbrella/Excess | Up 4.7% |

| Commercial Auto | Up 8% |

| Workers’ Compensation | Flat 0% |

| Professional Liability | Up 3.7% |

| D&O Liability | Up 3.3% |

| EPLI | Up 1.7% |

| Fiduciary | Up 1.3% |

| Crime | Up 1.3% |

| Surety | Up 1% |