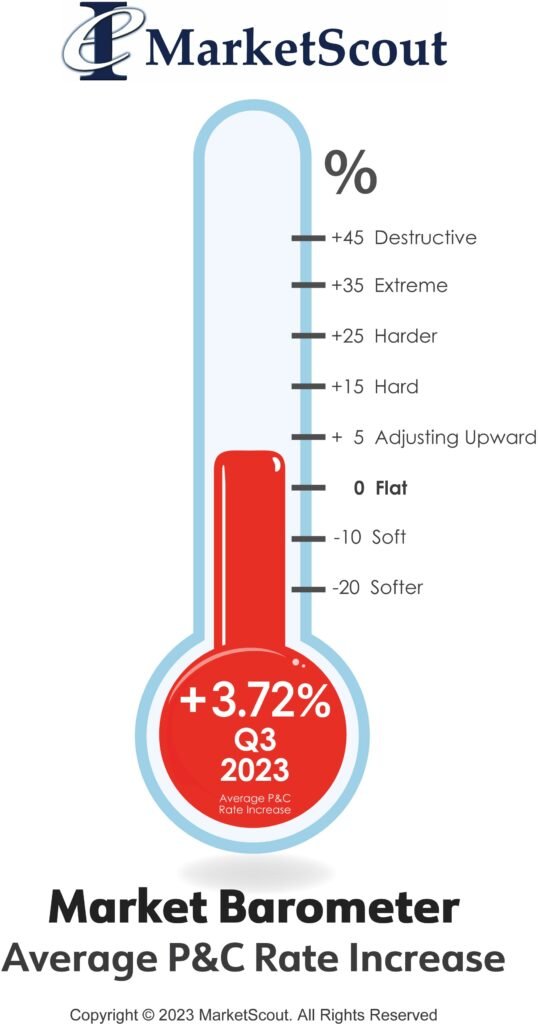

In 2023, third quarter commercial insurance rates were plus 3.72% as compared to plus 5% in the second quarter.

Rates for all coverage classifications except business owners policies (BOP) moderated in the third quarter. BOP rates increased from plus 3.2% to plus 5%.

By industry group and account size, every category enjoyed rate moderation.

“Reinsurers have been tough on insurance company partners the last twenty-four months, says Richard Kerr, CEO of Novatae Risk Group. “We see their stance moderating. The enhanced terms are being passed along to insurers and their customers. Higher interest rates also help support reinsurers’ results, so that could be a part of the reason for moderating rates as well.”

“Some property underwriters do feel rates should continue to increase because of their concern about global warming, which is somewhat affirmed by our hottest summer on record in 2023,” added Kerr.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

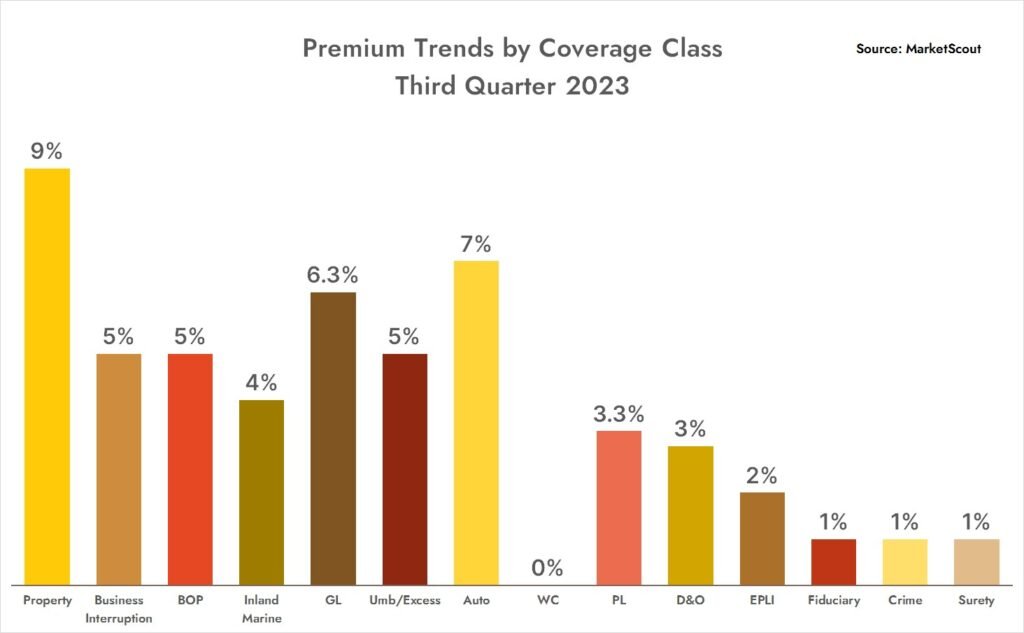

A summary of the third quarter 2023 rates by coverage, cyber liability, industry class and account size is set forth below.

| By Coverage Class | |

| Commercial Property | Up 9% |

| Business Interruption | Up 5% |

| BOP | Up 5% |

| Inland Marine | Up 4% |

| General Liability | Up 6.3% |

| Umbrella/Excess | Up 5% |

| Commercial Auto | Up 7% |

| Workers’ Compensation | Flat 0% |

| Professional Liability | Up 3.3% |

| D&O Liability | Up 3% |

| EPLI | Up 2% |

| Fiduciary | Up 1% |

| Crime | Up 1% |

| Surety | Up 1% |