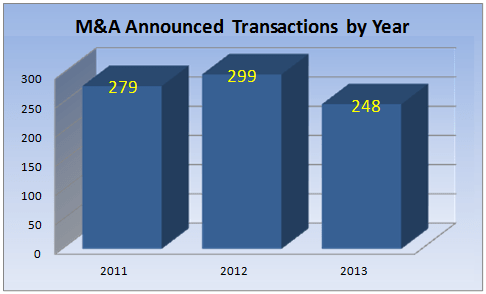

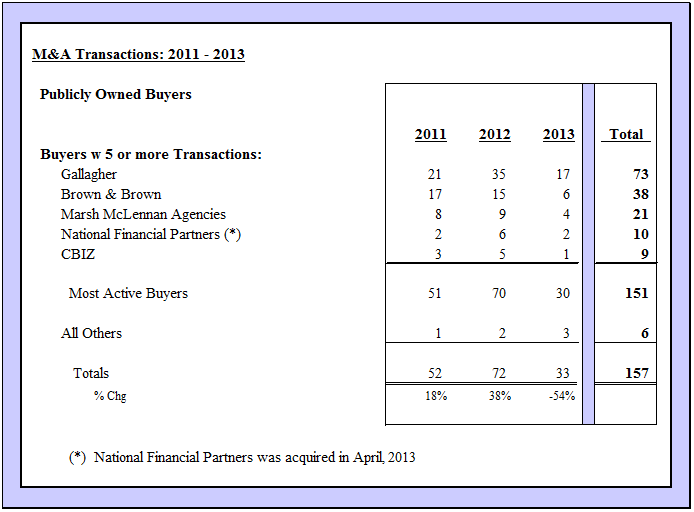

Table C3 – List of Major Buyers by Type, 2011 thru 2013

Publicly Traded Insurance Brokers

Click on image to enlarge

{simplepopup link=image12}

{simplepopup popup=false name=image12}

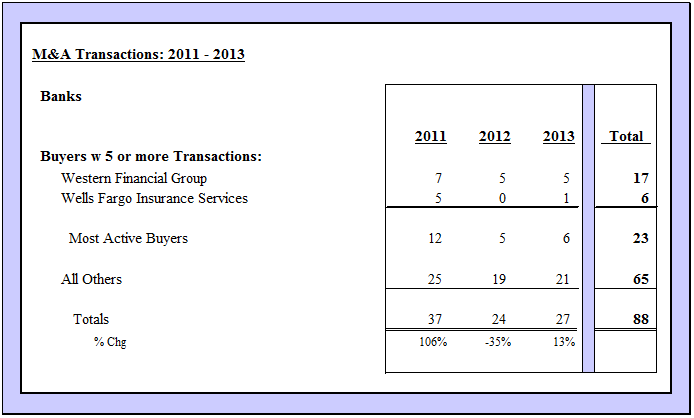

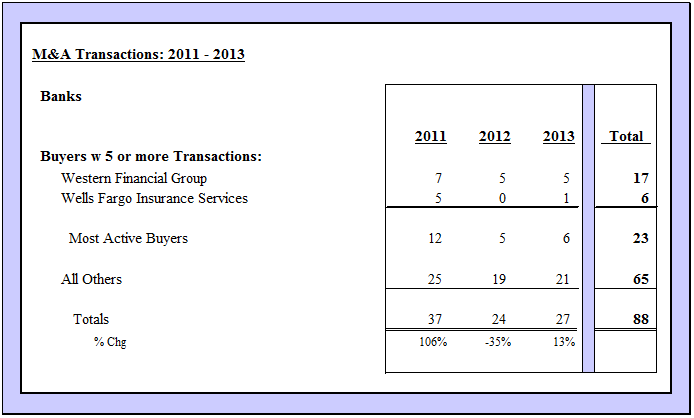

Table C4 – List of Major Buyers by Type, 2011 thru 2013

Banks

Click on image to enlarge

{simplepopup link=image13}

{simplepopup popup=false name=image13}

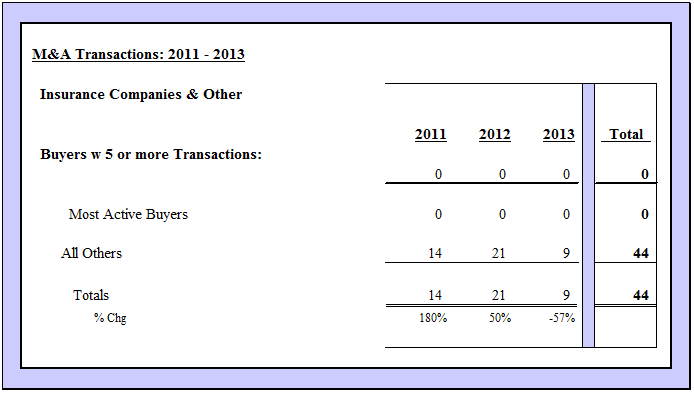

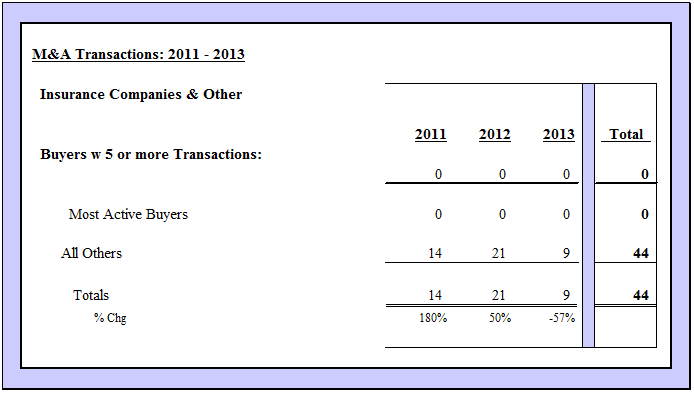

Table C5 – List of Major Buyers by Type, 2011 thru 2013

Insurance Companies and All Other Buyers

Click on image to enlarge

{simplepopup link=image14}

{simplepopup popup=false name=image14}

Source of Data:

Data is for US and Canadian transactions in the insurance “Distribution Sector “; Retail Property & Casualty (“P&C”), Employee Benefits and Life/Financial Services (collectively “EB”); Wholesale including MGA/MGU; Third Party Administrators “(TPA”) and other related entities..

Data has been obtained for reported transactions from various sources including, but not limited to, press releases, trade press and company websites.

Firms with Private Equity (“PE”) backing shown throughout this document and on Table D (pp. 13-15) also includes the PE firm names in parentheses; e.g. Hub International (Hellman & Friedman).

From the historic high level of M&A activity in 2012, 2013 marked a return to normal levels as buyers assimilated all their 2012 deals and they began to refill the pipeline of potential target sellers. Sellers, conversely, dealt with lower net sales consideration due to higher capital gains tax rates effective January 1, 2013.

As expected, the deal count was down in 2013 due to the push to close transactions before year end and avoid the impact of higher taxes. In addition, there are factors that will likely drive significant M&A activity for, minimally, the foreseeable future.

OPTIS Partners, LLC is a boutique investment banking and consulting firm with headquarters in Chicago and an office in Minneapolis, focused exclusively in the insurance distribution marketplace. We provide buy-side and sell-side M&A services, ownership succession planning, fair market valuation and related consulting services. OPTIS was ranked as the fifth most active agent-broker M&A advisory firm in 2013 by SNL Financial.