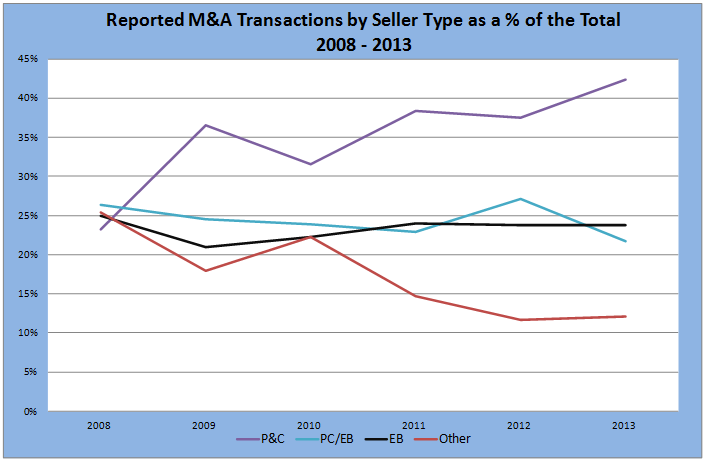

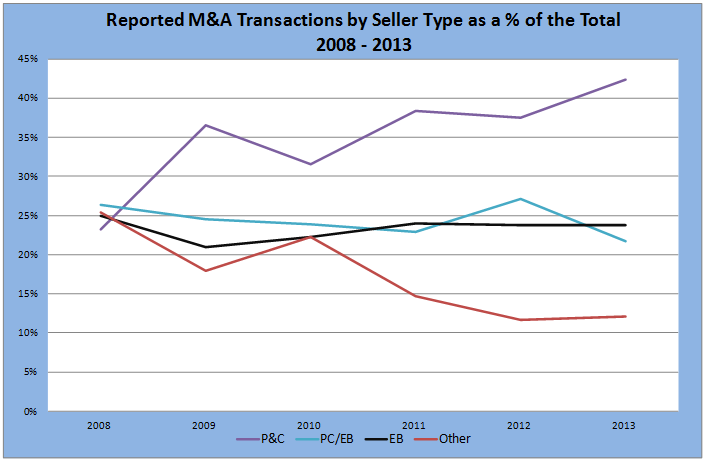

The business focus of the selling agency, segmented at primarily P&C, primarily EB, PC/EB combinations, and Other (Wholesale including MGA/MGU, TPA) is interesting especially with the large number in the EB and PC/EB combination in spite of the uncertainly regarding the impact of healthcare reform on the EB sector.

Firms with a primary P&C focus are dominant with over 40% of all announced transactions in 2013 compared to roughly 25% back in 2008. The 2008 year is interesting in that all categories were roughly equal in the [percentage of the total. Further to the reference above, it is likewise interesting to note the relative stability of the EB and PC/EB firms’ activity levels over the past six years and recently in spite of the unknown impact of healthcare reform.

Click on image to enlarge

{simplepopup link=imagesix}

{simplepopup popup=false name=imagesix}

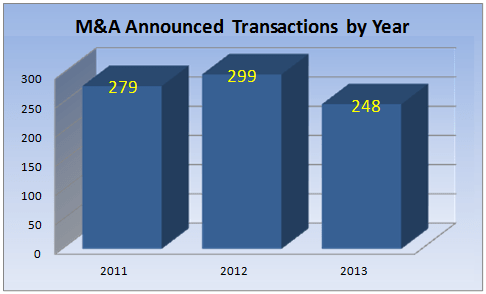

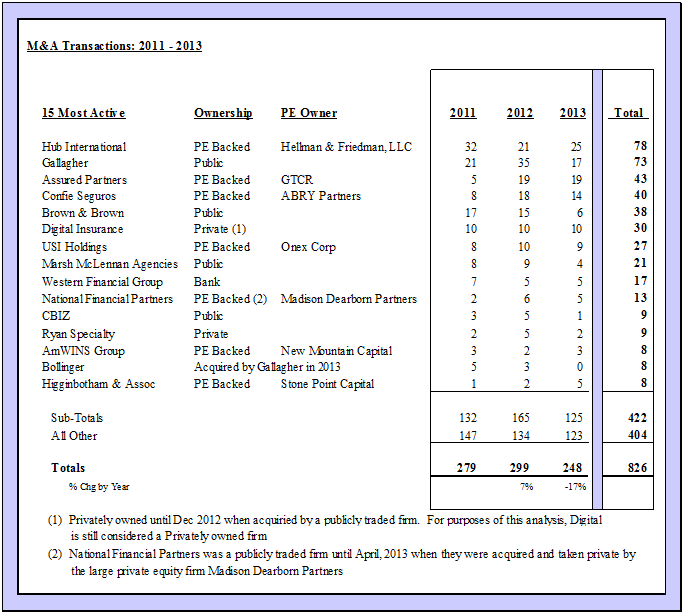

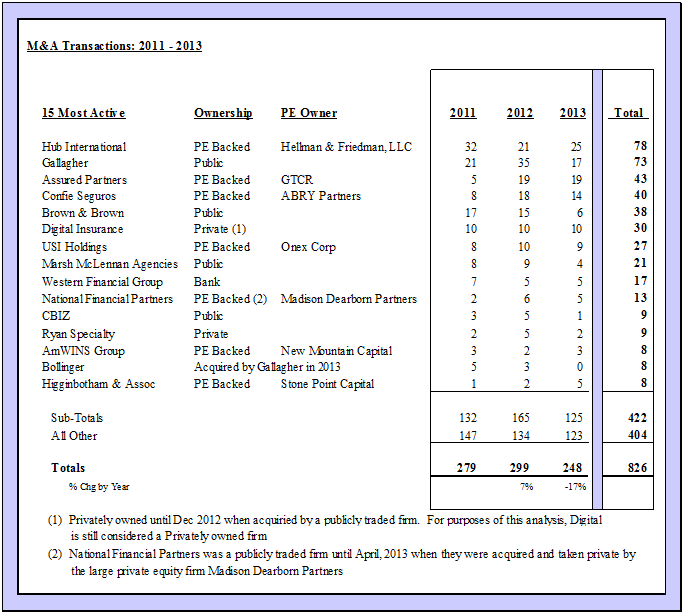

There were two firms over the past three years leading the M&A charge: Hub International with 78 deals and Gallagher with 73 total transactions. Eight others completed more than 10 transactions over the same time period, as illustrated in the table below.

Click on image to enlarge

{simplepopup link=imageseven}

{simplepopup popup=false name=imageseven}

Over 50% of all announced transactions came from the top 15 buyers over the last three years with each completing eight or more transactions in that time period. Of the remaining 404 transactions, there were an additional 284 acquirers, with over 200 of them completing only one acquisition.

Tables C1-C5 (pp. 14-18) provides additional detail on the most active acquirers from 2011-2013 by Buyer Type.

Summary:

January 2014 was one of the most active months on record for closed deals following the very robust Q4 2013. Such momentum would seem to indicate 2014 will be a very active year. While it remains to be seen if 2014 will be as active as the blockbuster 2012 year, there is every indication this will nevertheless be a banner year.

There are two primary factors having a major impact on future M&A activity. On one hand, the PE backed buyers seem to have taken the upper hand. Acquisition capital is not an issue and the anecdotal evidence would suggest they have pushed the multiples a bit in order to induce sellers to cast their lot with this segment. On the other hand, the conventional public brokers need to grow and expand their earnings base or suffer the consequences with pressure on their stock price. Organic growth has been good recently albeit up and down over the years and thus the next best alternative is to acquire the growth.

Lastly, not surprisingly but the demographics of agency principals matches the demographics of America. The massive boomer generation is coming of age and in need of implementing their exit strategy. The recent Big I Agency Universe Survey disclosed that 35% of all agency principals holding more than 20% of the equity in their firms are age 56 and older. Those principals have two markets to utilize to capitalize their value; they can sell internally to key staff or sell externally to a third party. The system is, on balance woefully unprepared to meet this massive perpetuation challenge. Consequently, there should be a large number of targets needing to partner with an acquirer and thus providing continuing momentum to keep the M&A machine moving forward.