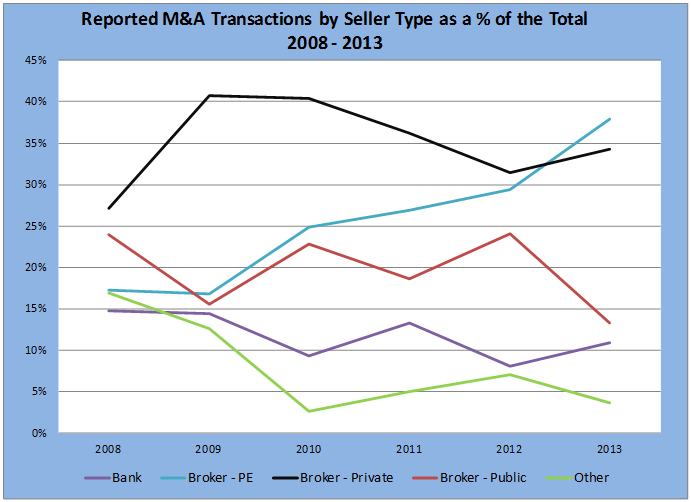

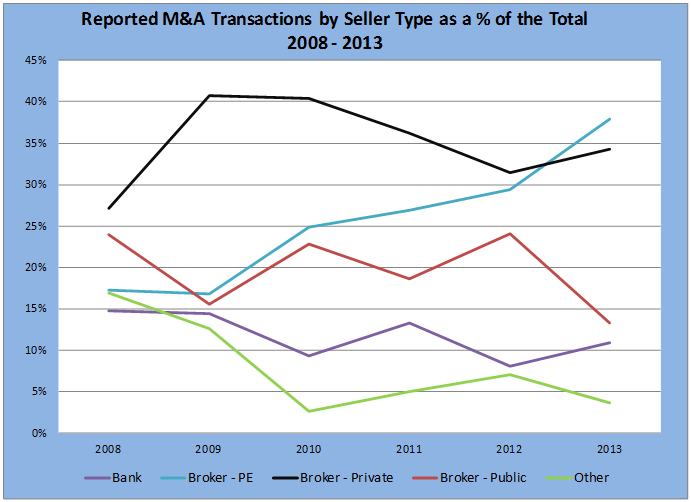

Buyer activity as a percentage of the Total sheds some additional light on the changes in the mix of buyer types over the past several years:

Click on image to enlarge

{simplepopup link=imagefour}

{simplepopup popup=false name=imagefour}

As reflected and discussed above, the growth of the number of transactions by the PE backed acquirers has been significant. Equally significant is the fall off amongst the Public Broker and Bank Owned acquirers.

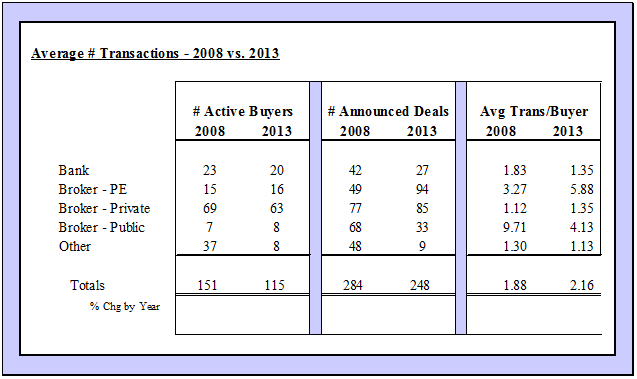

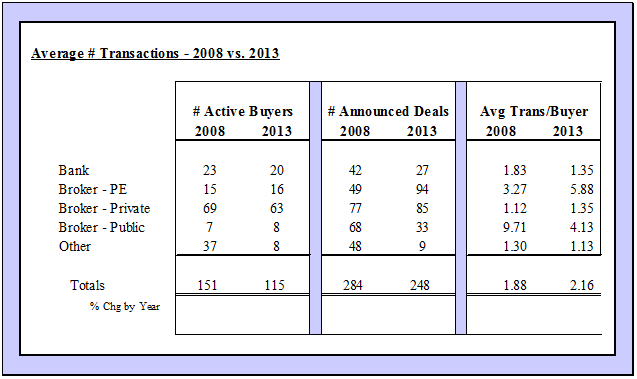

Although there has been some change in the PE group over the past 6 years, most notably the start-up of Assured Partners in 2010 and the sales of Bollinger and Beecher Carlson in 2013, the total number of PE backed agency buyers have not changed to any material degree. In 2008, 15 PE backed firms closed 49 transactions representing an average of 3.27 deals per buyer. Fast forward to 2013 and we find 16 different PE backed firms closing a total of 94 transactions for an average of 5.88 per buyer representing almost double the average number of transactions per buyer (see table below). In 2008, there were only two PE firms that announced five or more transactions (Hub with 16 and USI with 7) compared to 5 PE buyers with five or more deals in 2013 (Hub with 25, Assured Partners at 19, Confie Seguros with 14, USI at 9 and Higginbotham announcing 5 transactions). See the table on page 10 for additional detail.

Click on image to enlarge

{simplepopup link=imagefive}

{simplepopup popup=false name=imagefive}

Conversely, the average number of announced transactions from the Public Broker group has fallen by more than 50%. Brown & Brown and Gallagher have been the dominant acquirers of this group. The number was likely down due to the large transaction each closed in 2013 (see next paragraph),combined with the large number of transactions closed in 2012 and the need to integrate what was acquired into their respective platforms.

There were four major transactions in 2013 that were recapitalizations of PE backed firms representing the existing PE entity’s equity being acquired by a new PE entity. These are not included in our transactional count. The transactions were:

- GCP Capital Partner’s equity in Acrisure was acquired by Genstar Capital in March

- Berkley Capital’s investment in Risk Strategies Co. was replaced by Kohlberg & Co. in June

- APAX Partners/Morgan Stanley’s ownership position in Hub International was acquired by Hellman & Friedman in August

- Stone Point Capital’s controlling interest in Edgewood Partners Insurance Center, dba EPIC, was purchased by The Carlyle Group in November

In addition, there were three major conventional type transactions effected in 2013. They were:

- National Financial Partners (9th largest in 2013 per the Business Insurance (“BI”) ranking and formerly a publicly traded company) was taken private by Madison Dearborn Partners, a PE firm, in April

- Beecher Carlson (#27 largest per the 2012 BI ranking), previously majority owned by Austin Ventures/FSPM, was acquired by Brown & Brown in June.

- Bollinger Inc. (#22 per BI ranking from 2012) was acquired by Gallagher in August from Evercore, a PE firm, and other minority shareholders