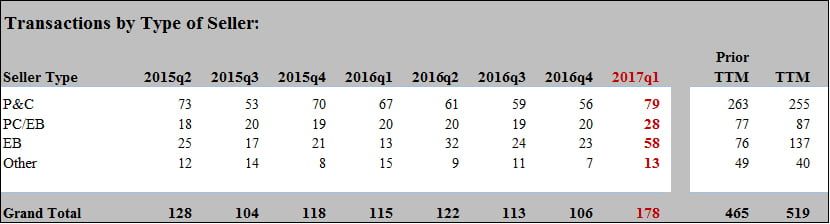

• P&C firms continue to be the focus of acquisitions with their highest quarterly count ever

• Sales of Employee Benefit (“EB”) firms jumped during the quarter, principally due to most of the Alera Group sellers coming from the EB sector.

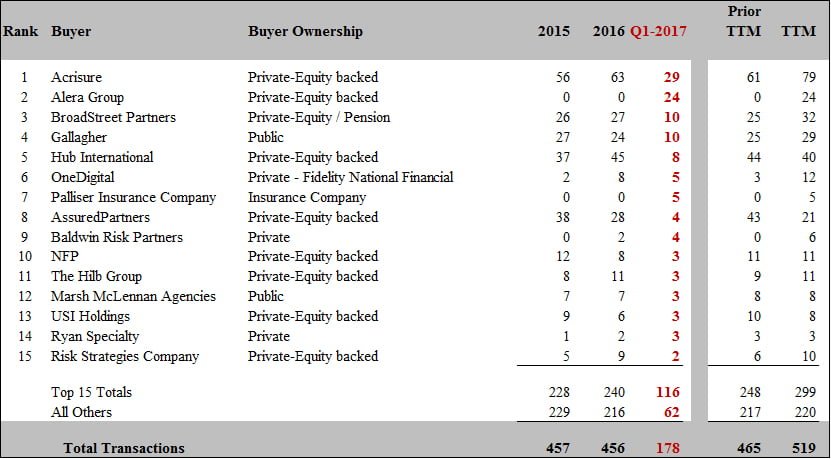

Going one step further in the analysis of the quarterly activity, the following chart shows the top individual buyers and their ownership type:

• Acrisure completed 29 transactions in Q1-2017; Acrisure has been the most active acquirer each quarter since the beginning of 2015 except Q2-2015 when they came in 2nd to AssuredPartners

• Alera Group, as referenced previously, with the simultaneous acquisitions of 24 brokerages in Q1-2017

• There are three new firms on the above list with Q1-2017 transactions (Alera Group, Canada based Palliser Insurance Company and Baldwin Risk Partners)

• A total of 68 separate buyers in Q1-2017 tied for the highest quarter with Q1-2015.

There were also six large notable transactions that were announced or closed during the quarter:

1. Marsh McLennan Agencies acquired J. Smith Lanier (#30 on the Business Insurance ranking in 2016) in January 2017

2. Canada based Western Financial Group, sold to Wawanesa Mutual, a Canadian insurance company, in February 2017

3. Keenan & Associates (#22 on the 2016 Business Insurance ranking) acquired by AssuredPartners in March, 2017

4. Capacity Coverage (#39 on the 2016 Business Insurance ranking) sold to EPIC in March, 2017

5. USI’s private equity partner, Onex Corporation, announced it would be selling its stake in USI (#9 on the Business Insurance ranking) to KKR and CDPQ in a transaction valued at over $4 Billion (with a “B”) in March, 2017

6. NFP (#11 on the Business Insurance ranking) received a capital infusion of $750 million from HPS Investment Partners to join Madison Dearborn Partners as the private equity sponsor.

Summary:

By all measures, 2017 will likely be another banner year for M&A. Most indicators are positive or trending positive notwithstanding some uncertainty-interest rates are still low but have started to move upwards, the economy continues to improve, insurance pricing remains relatively stable albeit soft in some sectors, reform of ACA is uncertain, and the stock market is up 15% over the past year.

Nevertheless, buyers are still being very aggressive in their valuations of prospective acquisition partners.

· Buyers remain willing and able to aggressively pursue acquisition opportunities with a robust pipeline of prospective sellers

· New private equity capital continues to flow into the broker space, indicating investors remain bullish on the industry

· Barring some calamitous events; geopolitical, terrorist, or a natural catastrophe, there is no indications of any factors negatively impacting M&A activity

· However, it will very likely change at some point to more reasonable valuations and transaction activity. When it does, whether you are a buyer or seller, you will need to adjust expectations and future plans accordingly.

· And as we’ve said in the past, if you’re neither buyer nor seller, simply focus on growing your agency and improving your metrics every day. Keep your long-term plans in sight and take the necessary steps to position yourself to achieve your goals.