No one wants to pay more in taxes than is absolutely necessary, yet many insurance agency owners unfortunately do. Your taxes can be minimized by having your income trend evaluated by a CPA who can help determine the best entity (C-corp, S corp, LLC, Sole proprietorship) to help minimize your taxes.

If you are limited liability company (LLCs), you need to elect how to be treated for tax purposes. The choices are: disregarded entity (meaning they are treated as a sole proprietorship or partnership if more than one owner), S-corp, or C-corp. For purposes of this article, we will focus on S-corps, C-corps, and sole proprietorships.

With a sole proprietorship all the revenues and expenses of the agency flow onto the Schedule C of the owner’s IRS Form 1040. The net profit is income to the owner and appears on the Schedule C.

With a C-corp, the owner of the agency is receiving a W-2 for his/her income and any profit retained in the corporation is currently taxes at 21% for federal purposes. However, when these profits are distributed to the owner (as dividends), these dividends are taxed to the individual receiving the dividends, i.e. the owner. This results in double taxation. To avoid this, most owners of C-corps bonus any profits out of the corporation. This bonus is included on the W-2.

S-corporations function a bit differently. S-corps do not pay taxes. The shareholder/owner is paid a salary which is documented on a W-2. Any profit in the S-corp appears on a Schedule K-1 which the shareholder records on his/her Form 1040. Whether the income shows up on a W-2 or a K-1, it is subject to federal income tax.

The big difference is in regard to FICA. Most people think that FICA is 7.65%. In reality, it is 6.2% for Social Security and 1.45% for Medicare. Remember that these amounts are paid by both the employer and the employee. So, for the purpose of an agency owner, he is really paying 12.4% for social security and 2.9% for Medicare. However, while social security is capped ($132,900 in 2019) there is no cap on Medicare payments.

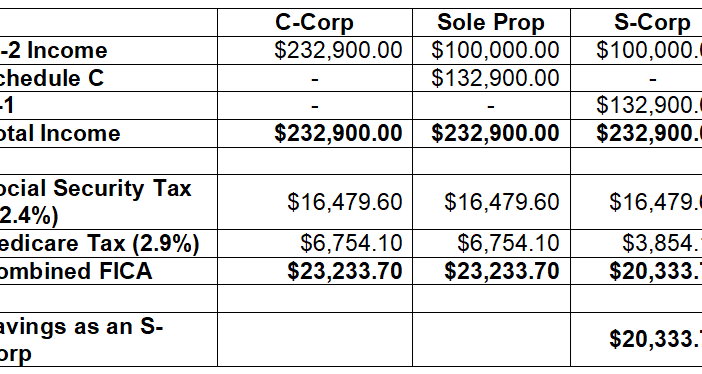

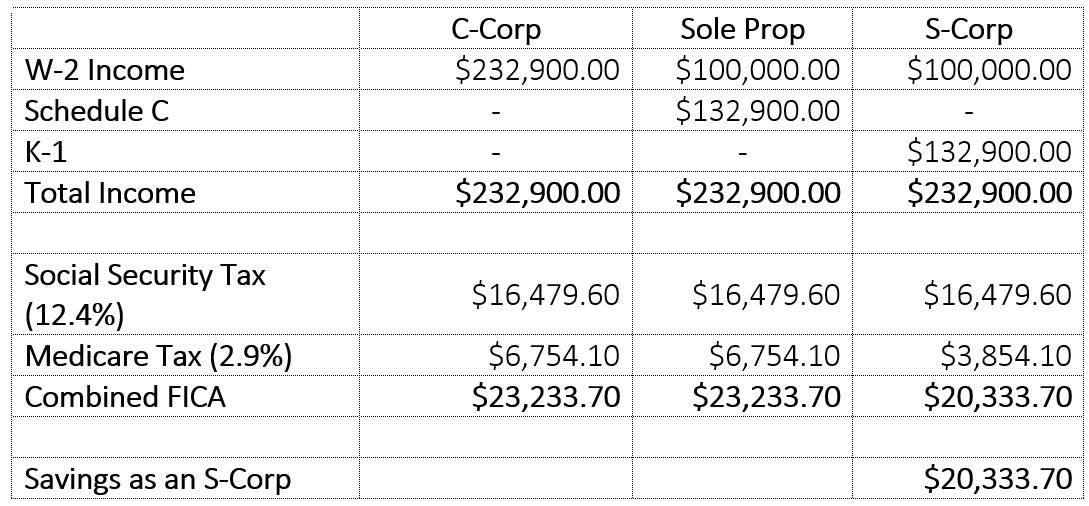

Assume you have $232,900 in income in 2019. As a C-corp you will need to take it all on your W-2 to avoid double taxation and will pay $23,233.70 between social security and Medicare. Since the IRS recognizes Schedule C income no differently than W-2 income, it will also pay $23,233.70 in FICA taxes.

However, K-1 income is not subject to FICA taxes which results in a savings of $2,900 in Medicare taxes to the agency owner in this example. For every $100,000 of income that is taken as profits, an S-corp agency owner can save $15,300 in taxes.

So why shouldn’t an S-corp agency owner take a salary significantly lower than $100,000, or even all of his income on his K-1 and totally avoid FICA taxes? There are several reasons:

IRS requires a person to take a reasonable amount of income on his W-2.

The less you pay in social security taxes, the less you will receive when it comes time to collect. The issues of salary vs. K-1 and the type of entity you are should be discussed with your CPA BEFORE the end of the year.