Property CAT and pending liability developments still worry insurers

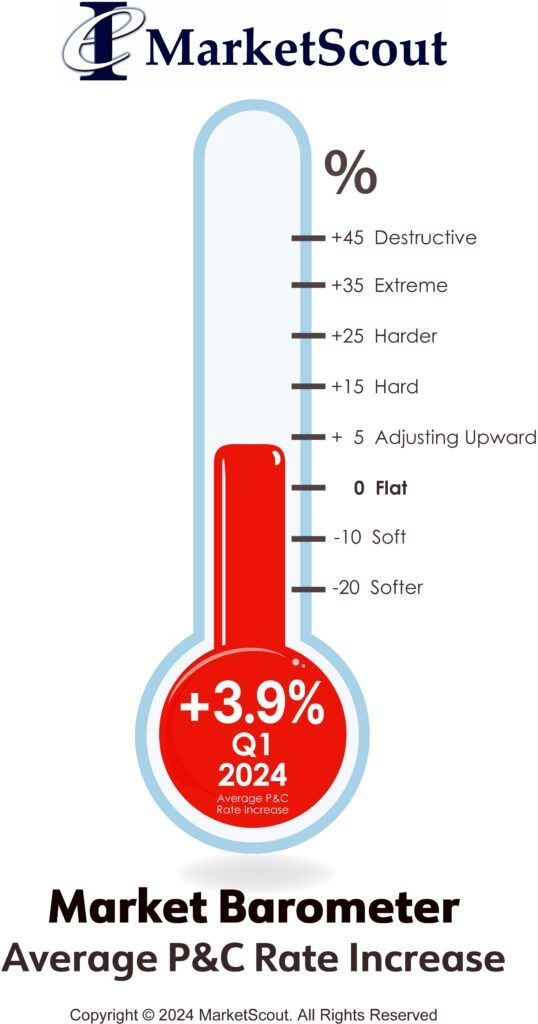

In the United States, the composite rate for commercial insurance in the first quarter of 2024 was up 3.9%, a notable decline from the fourth quarter of 2023, which was plus 5.6%. Richard Kerr, CEO of Novatae Risk Group noted, “January and February posted very modest rate increases; however, rates were trending upward more aggressively in March. Property insurers are nervous about the 2024 catastrophe season. Liability insurers are more calm but economic conditions and incurred, but not yet reported, claim estimates may impact rates later in 2024.”

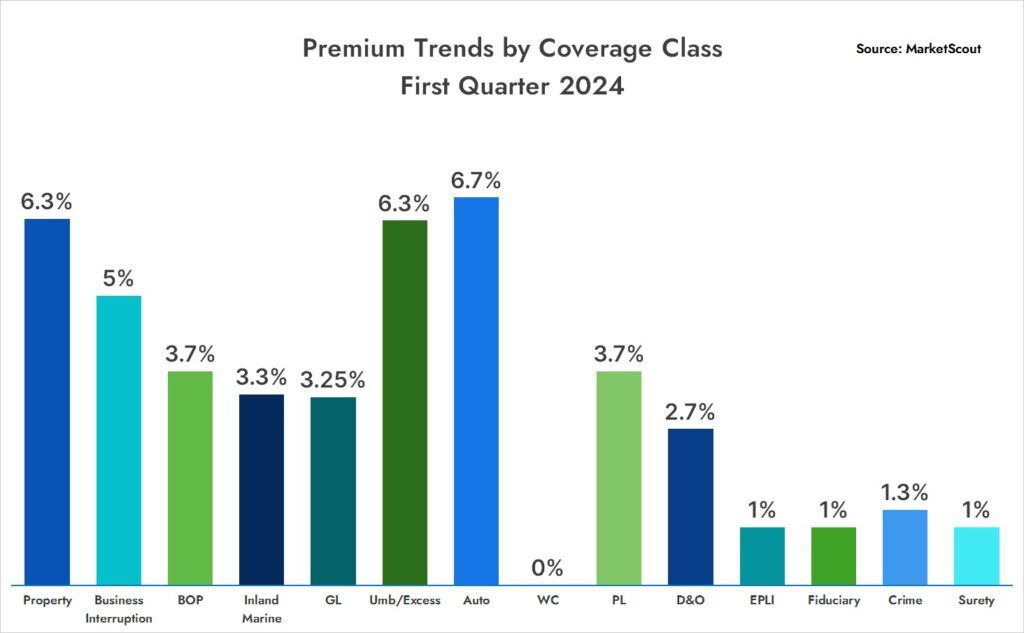

Auto and property insurance rates remain the highest among all coverages at plus 6.7% and plus 6.3% respectively. By industry group, transportation risks are being assessed with the highest rate increases at plus 6.7%.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the first quarter 2024 rates by coverage, cyber liability, industry class and account size is set forth below.

| By Coverage Class | |

| Commercial Property | Up 6.3% |

| Business Interruption | Up 5% |

| BOP | Up 3.7% |

| Inland Marine | Up 3.3% |

| General Liability | Up 3.25% |

| Umbrella/Excess | Up 6.3% |

| Commercial Auto | Up 6.7% |

| Workers’ Compensation | Flat 0% |

| Professional Liability | Up 3.7% |

| D&O Liability | Up 2.7% |

| EPLI | Up 1% |

| Fiduciary | Up 1% |

| Crime | Up 1.3% |

| Surety | Up 1% |