Insurers relax increases in select industries

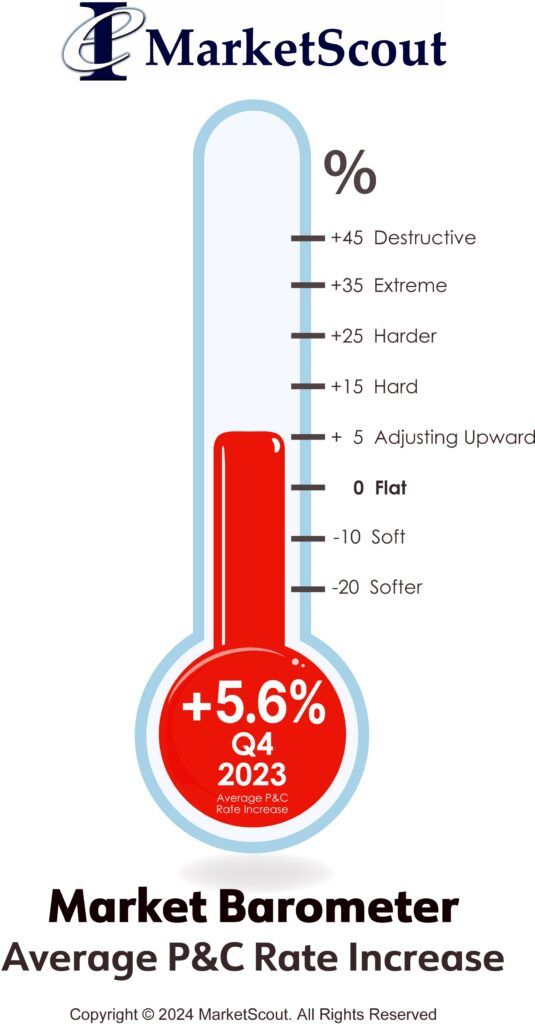

The US commercial insurance buyer paid a slightly lower premium on average in 2023 versus 2022. In the third quarter, rates were only up 3.72%, but in the fourth quarter, rates increased to 5.6%, resulting in a total rate increase for the whole of 2023 of 4.56%.

By coverage classification, property and auto rates were up the most in 2023, at plus 9.33% and plus 7.33%, respectively. Workers’ compensation was flat with no rate adjustment on average. Many states had rate decreases. Some states had workers’ compensation rate decreases.

In 2023, the transportation industry was assessed the largest rate increases by industry group at plus 7.26%.

“Calendar year 2023 settled down a bit as compared to the last few years,” said Richard Kerr, CEO of Novatae Risk Group. “Property insurers are still cautious, but they are optimistic 2024 could yield good returns, especially with the rate increases of the last several years. Throughout 2023, liability insurers assessed sensible rate increases.”

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

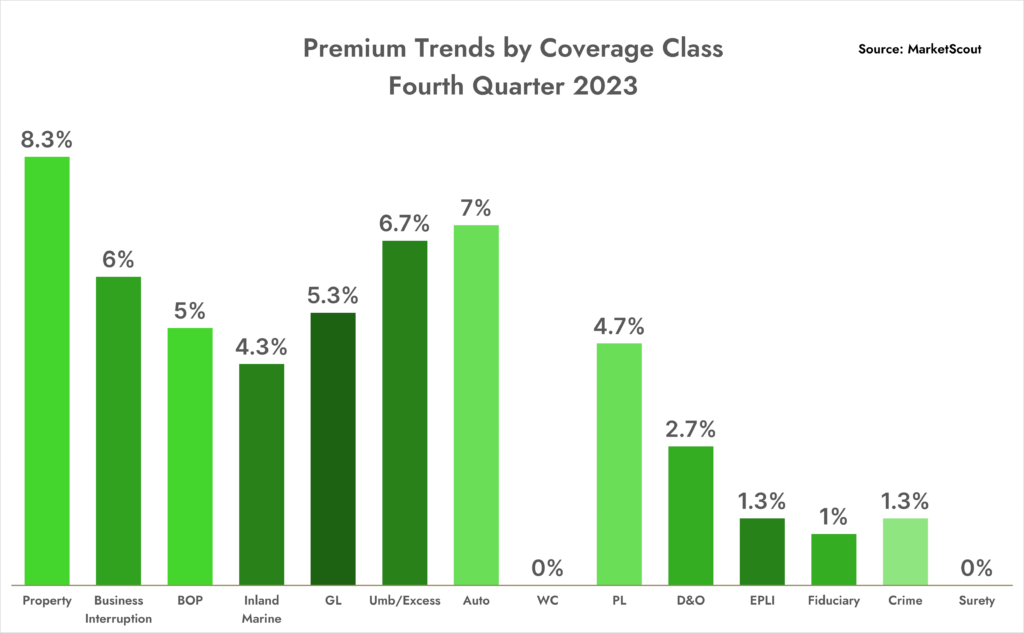

| A summary of the fourth quarter 2023 rates by coverage, cyber liability, industry class and account size is set forth below. |

| By Coverage Class | |

| Commercial Property | Up 8.3% |

| Business Interruption | Up 6% |

| BOP | Up 5% |

| Inland Marine | Up 4.3% |

| General Liability | Up 5.3% |

| Umbrella/Excess | Up 6.7% |

| Commercial Auto | Up 7% |

| Workers’ Compensation | Flat 0% |

| Professional Liability | Up 4.7% |

| D&O Liability | Up 2.7% |

| EPLI | Up 1.3% |

| Fiduciary | Up 1% |

| Crime | Up 1.3% |

| Surety | Flat 0% |