Catastrophe Prone Areas Continue to be Hammered with Large Increases

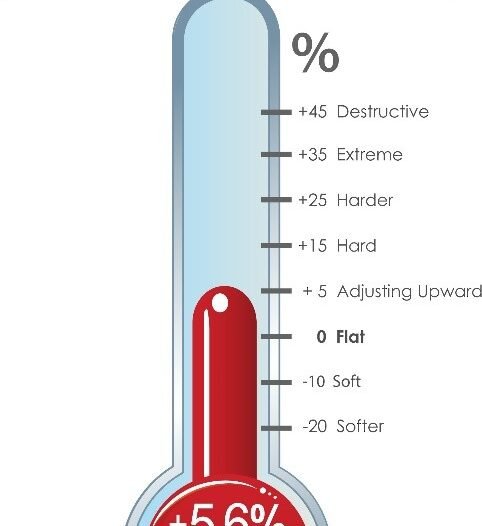

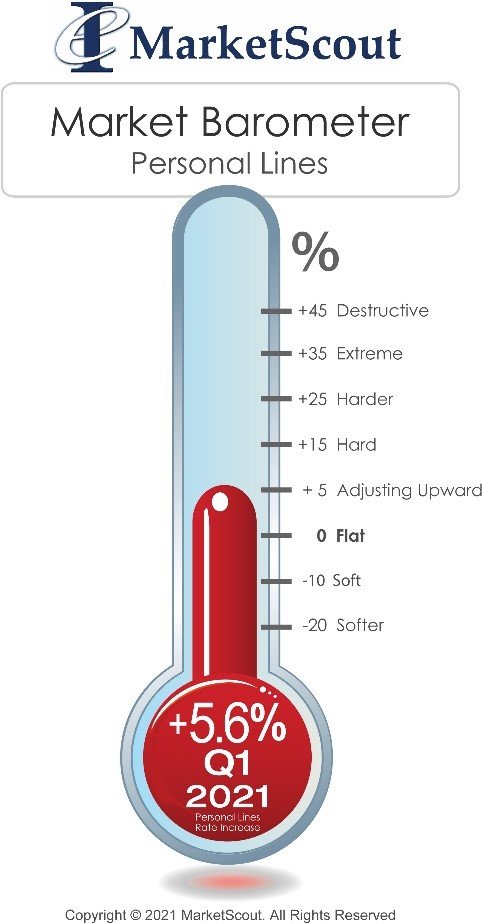

US personal lines market was assessed a composite average rate increase of 5.6 percent in the first quarter 2021 as compared to 6.3 percent in the last quarter of 2020. Richard Kerr, CEO of MarketScout, said, “While rates moderated slightly, the market continues to harden for homeowners in Florida and California. Insurers are cutting back and homeowners are paying the price. If you own a CAT exposed home in Florida or in a wildfire prone area in California, the rate increases can be as much as 25 to 30 percent.”

Automobile and personal articles rates were down slightly in the first quarter.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

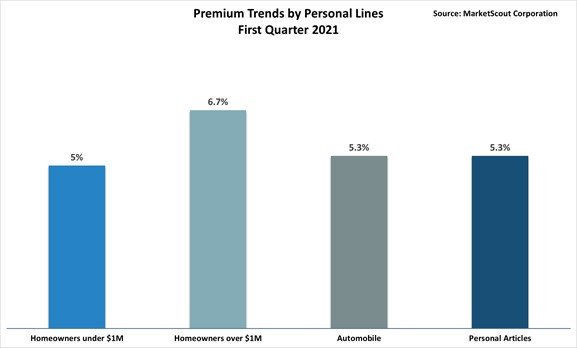

A summary of the first quarter 2021 personal lines rates is set forth below.

| Personal Lines | |

| Homeowners under $1,000,000 value | Up 5% |

| Homeowners over $1,000,000 value | Up 6.7% |

| Automobile | Up 5.3% |

| Personal Articles | Up 5.3% |