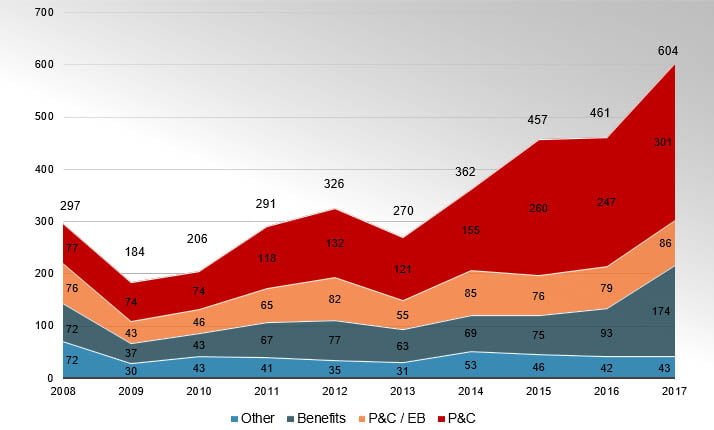

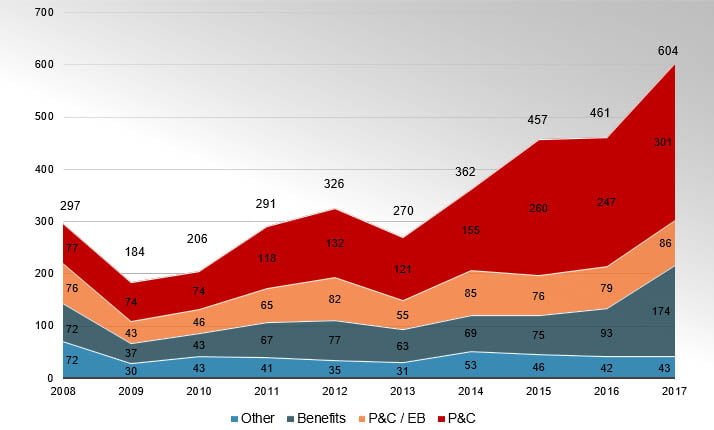

Highlights of 2017 M&A Activity

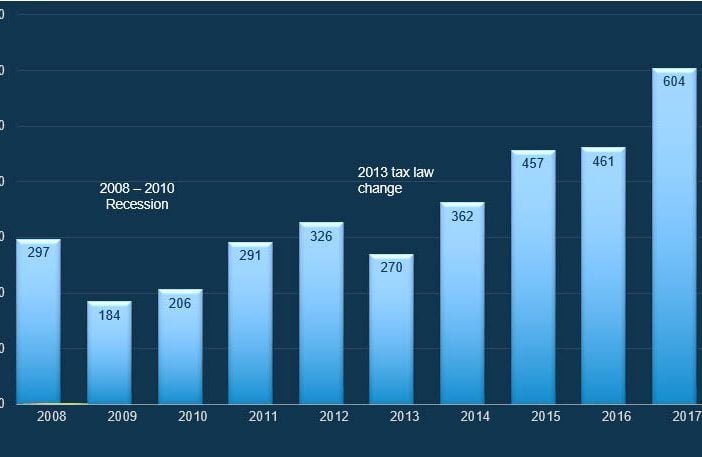

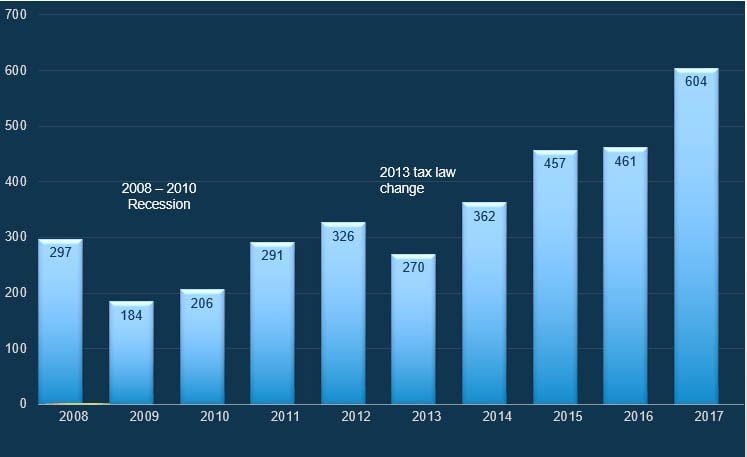

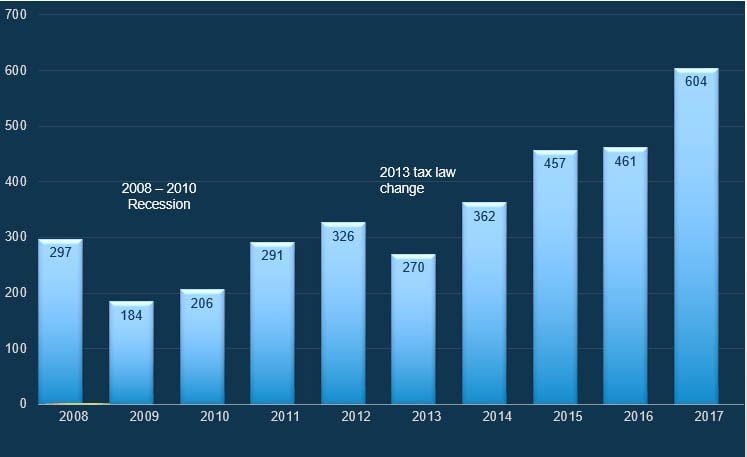

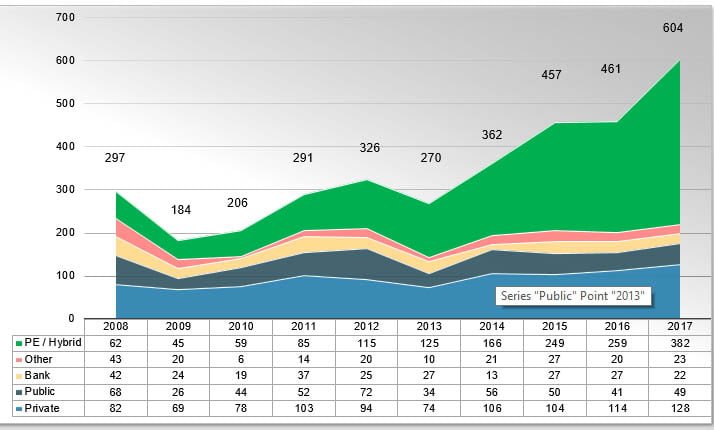

- A Whopping 604 announced transactions in the US and Canada, a 31% increase over the 461 deals from 2016!

- Acrisure completed 92 deals, followed by Hub (49), Alera (38), Broadstreet (32) and Gallagher (30)

- Assured Partners (26), NFP (24) and Seeman Holtz (23) all closed more than 20 transactions, and three others completed more than 10 transactions

- The Top 10 buyers accounted for 56% of all transactions in 2017, up from 52% in 2016

- There were 173 unique buyers in 2017, up from 153 in 2016, including 126 that only completed one transaction, up from 108 in 2016

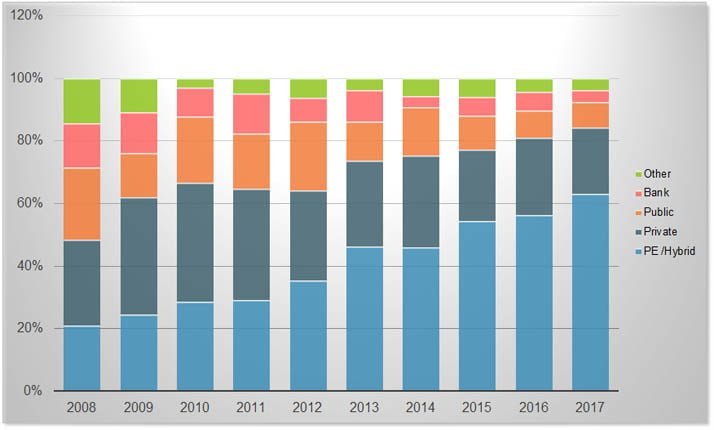

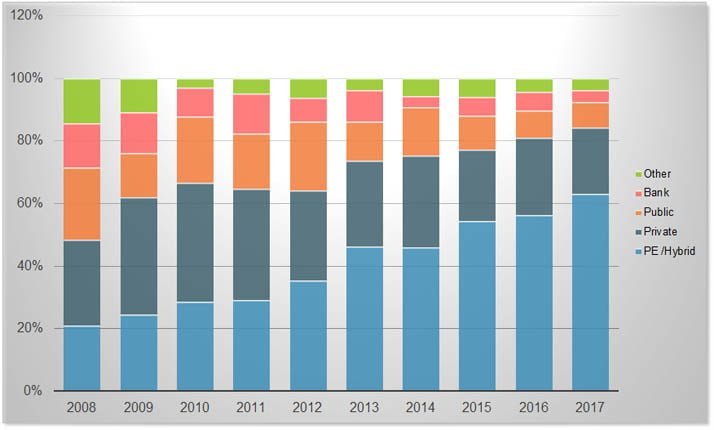

- A new classification of Buyers (PE / Hybrid), combining the private equity-backed firms and privately owned firms with significant M&A financial support, yielded 382 of the 604 (63%) transactions, up from 56% in 2016.

- P&C sellers remained the dominant target, with 301 transactions, but EB firm sales increased from 93 deals in 2016 to 174 in 2017, led by Alera (0 to 26) and Acrisure (12 to 43), as well as nearly all of the other highly active buyers

- There were five agencies from Business Insurance’s most recent Top 100 list that sold in 2017 (J. Smith Lanier, Capacity Coverage, Keenan & Associates, Frenkel & Co. and Wells Fargo Insurance Service)

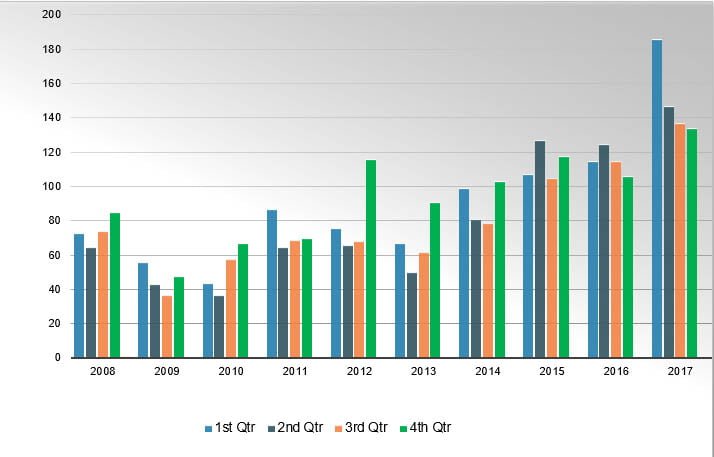

Summary Agency Acquisitions by Year

Click on image to enlarge

{simplepopup link=imageone}

{simplepopup popup=false name=imageone}

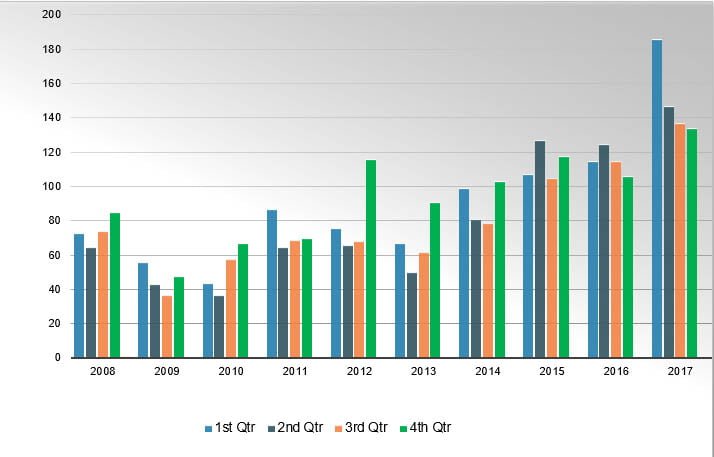

Agency Acquisitions by Year by Quarter

Click on image to enlarge

{simplepopup link=imagetwo}

{simplepopup popup=false name=imagetwo}

Changes in 2017 Buyer Classifications:

- Due to “blurred” lines between Private and Private-Equity backed firms, the category of the buyer types has been changed to the acquisition activity with the financial attributes of the buyers.

- The Buyer categories will now be as follows:

- Publicly Traded

- Privately owned

- Private-Equity owned and very active privately owned, all with acquisition capital support from their PE Sponsor, outside lenders and/or internal cash flow, will be referred to as “PE / Hybrid” buyers

- Banks and financial institutions

- Other (Insurance companies, non-insurance industry)

- The following Buyers have been reclassified from Privately Owned to PE / Hybrid buyers for all historical transactions:

- Acrisure (*)

- One Digital (*)

- World Insurance Associates

- Seeman Holtz Property & Casualty

- Baldwin Risk Partners

(*) Only changes transactions by Acrisure subsequent to their Nov 2016 recapitalization event and OneDigital transactions while they were owned by Fidelity National Financial (Sept 2012 – Mar 2017)

Agency Acquisitions by Buyer Type

Click on image to enlarge

{simplepopup link=imagethree}

{simplepopup popup=false name=imagethree}

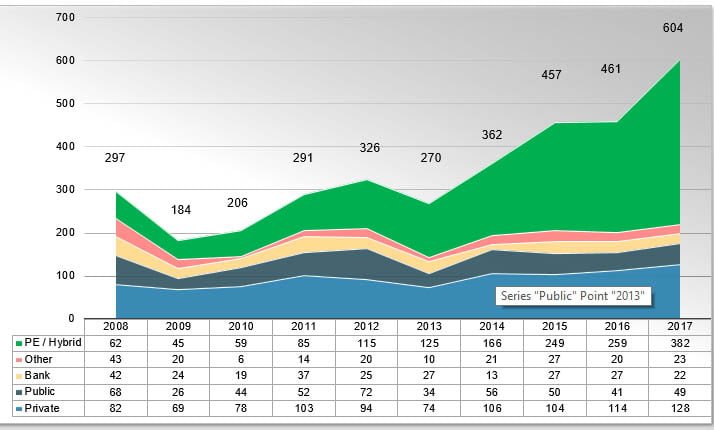

Acquisitions by Buyer Type as % of Total

Click on image to enlarge

{simplepopup link=imagefour}

{simplepopup popup=false name=imagefour}

Agency Acquisitions by Seller Type:

Click on image to enlarge

{simplepopup link=imagefive}

{simplepopup popup=false name=imagefive}