By: Paul Clarke, Executive VP and COO, PPCLOAN

Coming off last Quarter’s report where I compared the ownership opportunities of Allstate, State Farm and Independent, I wanted to further look at the Allstate opportunity and try to determine what makes one Allstate Agency more valuable than another.

I often get calls from sellers or even buyers who say they are looking at the Allstate Agency Value Index and are trying to pinpoint the exact value or sales price of a particular Allstate Agency by looking at PPCLOAN’s report. At this point, I remind them that the Allstate Agency Value Index is an average of agency sales and that no single Allstate Agency sells for exactly the average. Certainly, there are many factors that will drive the final sales price of an agency above or below the average, given that buried within the average multiple in the AAVI are agencies that sold for less or more than the average. Some even sold for much less or much more than the average due to various factors and circumstances surrounding the sale. The bottom line is that not all Allstate Agencies are created equal.

In an effort to make this Quarter’s Editorial as reader friendly as possible, I have decided to make a TOP 10 LIST of the most important items and issues that affect the value of an Allstate Agency. The list was compiled by analyzing the buying habits of Allstate Agency purchasers, through interviews, conversation at various meetings like the National Forum, and analysis of individual agency purchase transactions.

TOP 10 LIST – DRIVING FACTORS OF ALLSTATE AGENCY VALUE

1. SIZE– Size continues to be the biggest factor driving the purchase multiple paid for an Allstate Agency. Certainly there are many factors regarding size that are attractive to buyers. The most apparent is the superior amount of take-home pay opportunity that a larger agency owner typically realizes compared to his peers with medium to smaller sized agencies.

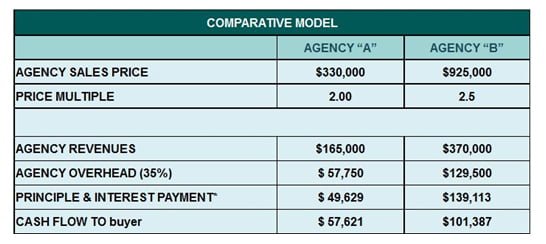

Let’s take a look at the example below:

Agency “A” receives approximately $165,000 in annual commission income, where Agency “B” receives approximately $370,000 in annual commission income. Both agencies are provided 100% financing in the chart above, with Agency “B” selling for a higher multiple. In the end, Agency “B” despite carrying a higher multiple of debt provides almost twice the amount of free cash flow to its agency buyer.

The above example is a prime case for why the size of an agency is the greatest determiner in the value of an agency.

2. AVAILABITY OF FINANCING– There are many small business owners that have similar revenues, profitability and business models as Allstate Agents. However, they cannot get anywhere near the value of their business at the time of sale due to the lack of financing readily available.

The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.

Why do Allstate Agents continue to get 2.0 to 2.5+ times commission income at the time of sale while CPA and Investment Advisors continue to receive pennies on the dollar relative to the amount of free cash flow available? It boils down to a lack of consistent and reliable sources of bank financing. But why are banks willing to lend money to Allstate Agents?

- Easy to control the collateral (cash is king and Allstate Insurance Company will remit the monthly loan payment directly to the lending institution each month).

- Relatively simple businesses to operate

- Allstate screening and management support

- TPP value – serves as a safety net, not the ultimate lendable value

3. RETENTION– Retention is a key component of any agency purchase, and one of the first things agency buyers and sellers will discuss when an agency sale is imminent. Retention tends to be the measuring stick when it comes to how much new business an agency buyer must write to maintain or grow their newly purchased agency. For example, let’s compare two agencies, both with $2 Million in Earned Premium:

- Agency “A” has 90% retention. For the purchaser to maintain the agency (assuming 10% of the agency’s premium is lost to attrition), the buyer of this agency must write $200,000 in new premium business during their first year of ownership. $300,000 in new business written would result in 5% annual premium growth. •

- Agency “B” has 80% retention. For the purchaser to maintain the agency (assuming 20% of the agency’s premium is lost to attrition), the buyer of this agency must write $400,000 in new premium business during the first year of ownership.

***At $400,000 in new business required to maintain Agency “B”, Agency “A” would have realized 10% growth in agency premium by retaining its retention ratio of 90%. Certainly, the demonstration above shows the importance of purchasing and maintaining a strong retention ratio.

4. AGENCY PROFITABILITY– No, I’m not talking about loss ratio, I’m talking about the amount of profit an agency owner realizes from operating their business. In 2011, I wrote an article titled “Businesses are meant to be profitable.” I got a lot of feedback from agents after this article was published. Many of these agents mentioned the difficulty they were having with regards to their businesses profitability, and many felt lost and didn’t know how to make their business more profitable.

At the end of the day, anyone purchasing a business wants to know that there is enough free cash flow to service any acquisition debt service that may be required to purchase that business. Allstate Agencies are no different. If an agency buyer has to come in and make drastic changes to the operating expenses of a seller’s Allstate Agency just to have enough cash flow to make his or her loan payment, the buyer is not likely to make this purchase at the price that is desired by the seller. On the other hand, if the business shows an extended history of consistent performance in the area of agency profitability, this can often result in top value being received by the Allstate Agency seller.

Rule of Thumb:

For every dollar of commission income that is wasted on unnecessary business expenses, or those expenses that do not generate a positive return, the buyer has less cash flow, diminishing their purchasing power. If you have a $2 Million earned premium agency to sell, and you have 5% in unnecessary business expenses included with your true operating expenses, this results in a purchaser having $10,000 less free cash flow per year, which if applied towards debt, could result in approximately $70,000 in lost value.

**Please note that when I mention unnecessary business expenses above, I am not talking about discretionary or personal expenses, as many business owners include a portion of these on their business tax return for obvious reasons. Any lender who consistently makes loans to Allstate Agents will have no issues in adding those discretionary expenses back to the net profit of the business, allowing for a loan in step with the maximum value of the business. I am talking about truly wasted or unnecessary business expenses that a buyer will incur that will hamper cash flow and the seller value – these include:

The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.

- Rent – If a seller has signed a lease that must be assumed by a buyer for an inefficient space, resulting in a higher than necessary occupancy costs being absorbed by the buyer (not at their choosing), that will negatively affect cash flow, and likely drive the final price of the agency down.

- Staff costs – If a sellers pays his staff above market value, or gives benefits typically not offered to Insurance staff, this will have a negative effect on cash flow and will likely result in a lower price being received for this agency at the time of sale.

- I always recommend business owners be smart with their staffing costs. Remember, staff is replaceable. You as the owner are not replaceable. Be the CEO of your business and make the hard decisions to ensure your interests are taken care of.

5. SELLER TRANSITION PLANS – The seller’s transition plans could potentially be the number one item on this list. I have seen many deals die because a buyer becomes uncomfortable with a seller’s plans after the sale. I have also seen a large-sized agency sell for just over TPP because the selling agent was not willing to sign a noncompete or solicit agreement that would provide ample protection to the agency buyer.

Word travels fast. If a seller has plans to stay in the business or violate a noncompete agreement, the buyer often finds out in advance of the sale. Of all the items on the list, the seller transition plan can be the most damaging for both the buying and selling parties.

There are many agency buyers who are dealing with lawsuits and disputes regarding violations of a covenant not to compete and solicit agreements with former sellers. On the flip side, many selling agents have been forced to take TPP as the market didn’t see the risk in purchasing an agency from an individual they knew was going to be a direct competitor following the sale.

6. COMPENSATION– When I talk about compensation, I am talking about the income received by an Allstate agent and what is required of the agency owners to receive that income. My personal opinion is that the proposed Variable Compensation model for 2013 (with relative ease for agents to get from 9% back to 10% comp) is ideal for maximizing Allstate Agency values, as it provides a healthy mix of fixed income (reward for historical performance / renewals), and contingent or bonus income designed to compensate agents for new business. If the compensation model was modified to compensate agency owners primarily for new business written, and the compensation received by agents for historical performance and client retention was diminished, then we will certainly see a reduction in the value of Allstate Agencies. Agency purchasers are buying the historical performance of an agency with the hopes of rewarding themselves for the future performance of the business under their own leadership.

7. COMPULSION TO BUY OR SELL– Compulsion is almost always bad and typically will negatively affect either the buyer or seller acting with compulsion. However, compulsion can be a part of a calculated strategy. I see three areas where Compulsion factors into the buy / sell process and affects the final price of an agency purchase:

a. Compulsion on the part of the buyer – These individuals are often outside buyers and it is often the case that buyer will “stretch” on a purchase because “It’s really close to home” or “I’ve just always really wanted to own my own business.” In these cases, the buyer is putting good business decision making on the sideline in their seemingly blind pursuit of an agency purchase. They do not have their business hat on, and will typically not walk away from a purchase that is screaming at them to walk away. These buyers usually overpay on price, and will even concede in very dangerous areas such as a covenant not to compete and a covenant not to solicit terms.

b. Compulsion on the part of the seller – Currently, the amount of compulsion I am seeing from sellers has diminished significantly. During 2011, and the early parts of 2012, many agents sold for less than full value due to their negative perception of Variable Compensation. PPCLOAN also financed many agencies where the selling agent was either terminated or felt a termination was eminent, and value was lost in these circumstances.

The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.

c. Experienced agency purchaser using compulsion as a strategy – What does this mean? Well, I have seen existing large and successful agency owners purchase another agency above market value as part of a bigger strategy (i.e. to obtain market share or eliminate a competitor). Ultimately, these individuals are paying above market value with little to no risk of failure due to the purchase being part of a purposeful business decision.

8. CURRENT AND EXPECTED LOCAL MARKET CONDITIONS – One of the most vocal topics of discussion PPCLOAN staff have with potential Allstate Agency buyers is: What are the current and expected market conditions for selling insurance in the local area of the agency being purchased. Being competitive or price proxy gives buyers confidence at the time of purchase, as everyone buying an insurance business wants to get off to a good start by having a climate that is conducive to writing large amounts of new business. Being in a market where competition has a significant edge can make potential buyers uneasy about paying top dollar for an agency. The current and future expected market conditions can be used by agency buyers to negotiate a reduced price, especially if the current reality and future outlook are gloomy. Conversely, if the market of the agency being sold has been strong for years, and is expected to continue to be strong, this can serve as a strong selling point for Allstate Agency sellers to get the maximum value for their agency.

This is one area where I have seen many agency purchasers getting burned, as they put too much stock in current positive market conditions, and they do not factor in a possible adverse future business climate that could make doing business harder.

Current and expected market conditions are important to buyers and seller when trying to determine the final purchase price of an Allstate Agency; however it must be taken with a grain of salt, as market conditions in the insurance business can change rapidly.

9. CORPORATE POLICY – In my opinion, the job of a CEO and those who work with and advise the CEO, are:

a. Position the company to ensure it continues beyond their tenure as an ongoing concern. Essentially, don’t take risks that might put the company out of business.

b. Maximize shareholder wealth.

Those in charge at any business have to make tough decisions every day. When focusing on the long-term health of the business, it is sometimes necessary to make unpopular decisions. One could argue that any decision a CEO makes will never be supported by 100% of those who work for or interact with the company.

As an Allstate Insurance agency owner, Allstate Home Office will make decisions that positively or adversely affect your business. Allstate Home Office also makes decisions that affect the employees, regions and management either in a positive, neutral or negative way.

One example of a corporate policy change was the allowance of agency mergers for the bulk of 2010 and 2011. Many smaller agency owners who wanted to sell reaped a benefit in the form of a higher sales price, as their agency became more attractive to the market of Allstate Agency buyers who saw more value in merging a small agency relative to the alternative of having it maintained as a single location. In this scenario there was also tremendous benefit received by agency buyers, be it outside buyers or existing agency owner’s, as they were able to achieve a significant economies of scale by having a single location and essentially eliminating duplicate expenses associated with maintaining multiple locations. With merger activity reducing in 2012, we will likely see some level of disappointment from existing agents and outside buyers alike as they are unable to achieve their desired agency size (#1 on the list) through a purchase, and hitting their business goals will likely be more contingent upon organic growth.

Corporate policy is an area that has a great deal of effect on the supply and demand economics of agency sales. In an ideal world where Allstate Agency values are maximized, there will always be more demand for a purchase opportunity than there is supply. Currently, the value of Allstate Agencies is very strong due to:

The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.

- The Allstate brand has a very strong reputation in the market.

- The agency ownership opportunity is a very unique entrepreneurial opportunity desired by many and not matched by any other major Insurance carrier.

- The product sold is a base need product that is required for purchase by the state and/or mortgagee, resulting in very inelastic demand for the product.

- Allstate provides significant training and support from field management to all its agents.

All these factors contribute to a nice equilibrium of supply and demand for Allstate Agencies which helps to ensure that agencies maintain healthy values in step with their economic value. Certainly, Home Office has been instrumental in developing and maintaining the positives mentioned above. However, corporate could also change direction and put policies in place that reduce the attractiveness of the Allstate Agency ownership opportunity. Some of the factors that could result in the equilibrium price of an Allstate Agency being reduced are:

- Dramatic shift in the compensation model from primarily fixed compensation to predominately variable or contingent compensation.

- Any event resulting in a flood of sellers (increased supply), where demand (those desiring to purchase) could not keep up.

- If the Allstate brand took a hit and was viewed by the customer pool as a less than reputable company to purchase insurance from (this negative stigma would likely stick heavily on the agency force).

- If the Allstate Agency ownership opportunity is seen as less than desirable by those looking for a career change.

10. DEATH– Death of an existing Allstate agency owner is not a very common occurrence as most agency owners sell their agency and enter retirement or another field of business prior to their own death. However, in those instances where an unexpected death does occur during a period of ownership, death could result in significant loss of agency value. In some instances a surviving spouse or widow will transfer the book into their own personal name or into the name of a child, and although this can be a lot of work, it can help preserve long-term value until the agency is sold (or in some cases the business is desirable to the widower or child and is maintained as a primary source of income).

The worst case scenario for a widower in the event of an owner’s death is receiving the TPP value or some nominal amount above TPP in an agency sale. PPCLOAN has seen several transactions that involved an unexpected death of an Allstate Agency owner where the agency was transitioned to another agent or outside buyer for less than market value. Instances even included high quality $3M to $4M agencies that sold for just pennies over TPP.

The lesson to be learned is prepare a succession plan as you are able, but realize Allstate must ultimately approve the buyer. Don’t wait until the last minute, as after the time of death will likely be the hardest time to quickly secure a buying candidate.

Ultimately, life insurance is the one sure safeguard for your heirs in the case of an unexpected death. Do not burden them with the task of selling your agency for top dollar following your death. Have ample insurance and leave them in a position to where any sale of your agency is strictly a cherry on the top of an already sound estate planning strategy.

Certainly, these Top 10 Factors are not the only factors driving the value of an Allstate Agency. Below, I have included a list of additional items than can be critical when determining the final value of an Allstate Agency:

- TURNKEY OPERATION– Does the seller have the processes, the people and the proper utilization of technology to make it easy for the purchaser to succeed?

- FINANCIAL STRENGTH OF BUYER– As a Seller, unless you get lucky and find that needle in a haystack Agency Purchaser who has cash to write a check for your desired purchase price, you are going to need a little luck when selling your agency with regards to the ability of a candidate to qualify for the desired amount of financing.

The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.

- LOCATION– Coastal vs. Non-Coastal

- LOCATION– Rural vs. Urban

- LOCATION– BRE / quality of the facility

- LOCATION– On a Desirable thoroughfare?

- BONUS– Another source of income to pay the bills. Also a great indicator of the quality of the agency

- MIX OF BUSINESS– Standard auto, commercial, homeowners

- THE ODD DUCK– For example, it may be hard for a $20Million Earned Premium Agency to receive all cash at closing

- SOURCE OF INCOME– Allstate P&C vs. bonus vs. brokerage income

- HOUSEHOLD PENETRATION

- LOSS RATIO

- FINANCIAL PRODUCTION / QUALITY EFS

- TPP

- AGE OF THE AGENCY

- AGENCY REPUTATION

ACTION PLAN

I know what you are thinking, “WOW, that’s a long list. What can I do with all this information?” I would recommend you focus on the items you can control. Certainly, there are many areas of focus to make your individual agency more valuable in a possible sale, and more valuable to you as the day to day operator.

Here is what I recommend:

- Go through the list and designate each item as a strength or a weakness for your agency

- Work on those items that you can control

- Start by attacking the low hanging fruit

- Set goals with deadlines – This is especially critical if you are possibly selling in the near future

Paul Clarke, Executive

Vice President and COO

Phone: (281) 419-0400

Email: paul@ppcloan.com