Prepared by Optis Partners

From the depths of the recession and the lean years of 2009 and 2010, insurance agency-brokerage Merger & Acquisition (“M&A”) activity certainly appears to have fully recovered.

{simplepopup link=imagethree}

{/simplepopup} {simplepopup popup=false name=imagethree}

{/simplepopup}

Click on image to enlarge

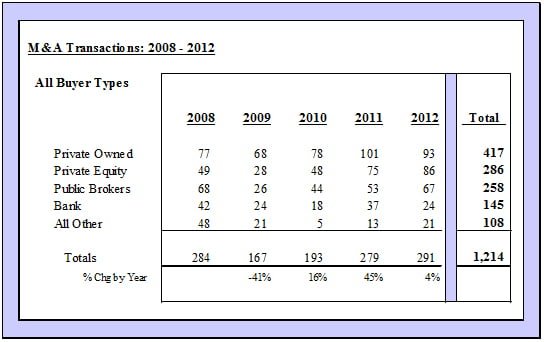

There were 291 announced agent-broker M&A transactions in 2012, the largest number since 2000. Previously the “best ever” year was 2008 with a total of 284 transactions. The meager years of 2009 and 2010 with 167 and 193 transactions, respectively, was reflective to a significant degree to the collapse of the economy. The market rebounded dramatically in 2011 with 279 transactions as the economy showed signs of recovery, albeit spotty, and the heretofore active buyers were ready to effect transactions in a big way. Sellers, too, were more confident in their ability to close a deal at attractive financial terms. The graph on Table A (p. 10) displays the total number of transactions from 2000 through 2012.

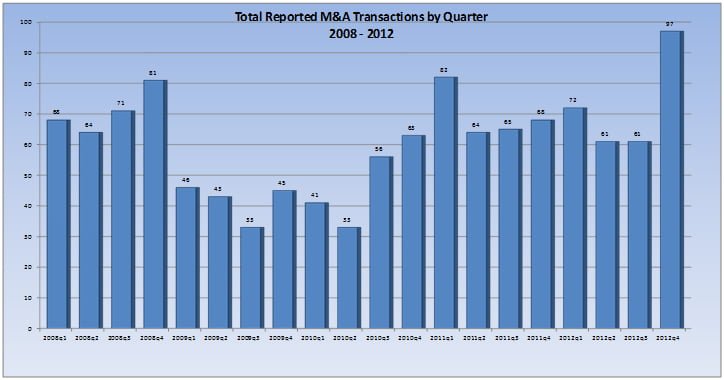

Quarterly trends in 2012 were generally similar to prior years with a reasonably active first quarter, scaled back second and third quarters, but then with a huge fourth quarter. Notwithstanding the first quarter of 2012 showed promise for an active M&A year, it did not commence with an indication it would be a record breaking year until the end of the year. The fourth quarter of 2012 significantly exceeded all prior year quarterly M&A levels; the 97 transactions in this quarter were almost one-third of the year’s total and over 40% greater than the fourth quarter of 2011.

{simplepopup link=imagetwo}

{/simplepopup} {simplepopup popup=false name=imagetwo}

{/simplepopup}

Click on image to enlarge

Total activity in 2012 and the fourth quarter in particular were clearly impacted to a significant degree by a highly motivated group of sellers joined together with a hardy buy-side climate. Sellers were especially interested in getting their deals done before year end 2012 to avoid the impending higher capital gains tax rate of 20% (versus 15%) and the new capital gains surtax for certain taxpayers of 3.8% as mandated by the Patient Protection and Affordable Care Act (“PPACA”). A sale transaction deferred to 2013 from 2012 will likely result in after-tax proceeds nearly 10% less as the result of these tax law changes.

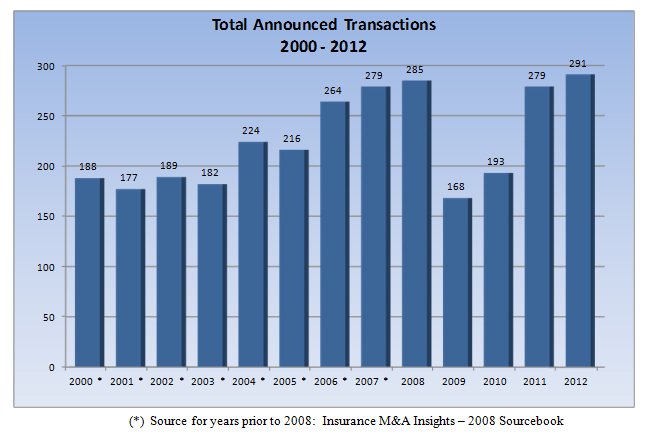

The total number of transactions in 2012 was only marginally higher than 2011 and 2008, but the changes in the activity of the various buyer groups over time is interesting, to say the least.

{simplepopup link=imageone}

{/simplepopup} {simplepopup popup=false name=imageone}

{/simplepopup}

Click on image to enlarge

The privately owned agency group actually declined in 2012 from the prior year, perhaps due to greater competition for deals as the public brokers and PE backed firms gobbled up ever bigger pieces of the M&A pie, accounting for 53% of the deals in 2012 compared to only 45% in 2011. In 2008, the public and PE backed firms only represented 41% of the total deals. On a stand-alone basis, PE firms have grown from 17% of the total in 2008 to 30% in 2012, a significant and steady increase over the past five years.