By: Paul Clarke, Executive VP and COO, PPCLOAN

A Comparative Look at the Allstate, State Farm, and Independent Agency Opportunities from the perspective of the Agency Owner

Ownership – Who has the best deal?

At a gathering of insurance professionals there would likely be as many answers to this question as there are agents in the room. This because to some degree comparing the ownership demands, overhead structure, profitability, risks, opportunities, etc. of owning an independent agency, an Allstate agency, and a State Farm agency is very much like comparing apples and oranges. Just as the old saying “America and Britain are two countries separated by a common language,” so too are these various venues for insurance agency ownership separated by a common product.

The point is that just because it is neat and easy for a wishful neighbor to look at the yard next door and observe that its commission rate is better (thus its proverbial grass is greener) does not make this relatively simplistic observation true. For instance, what if our wishful neighbor were to find out that he would have to be willing to work roughly 12 hours a day, or tolerate 70% overhead, or deal with multiple insurance carriers and their multitude of forms and processes, or would not be allowed to sell his agency at retirement? A good bet is that he might begin to see that his narrow commission observation comes with a lot of undesirable strings attached. It brings to mind another old saying, “You don’t get something for nothing.”

Within the Allstate Family one will hear a good deal of talk regarding agency ownership and commission opportunities outside of Allstate. In particular is seems opportunities involving independent agency ownership and ownership of a State Farm Agency are popular focuses of discussion. However, my gut tells me that the full experience of being an Insurance Agency Owner cannot be fully appreciated by simply looking at the base commission rate received by an individual agent.

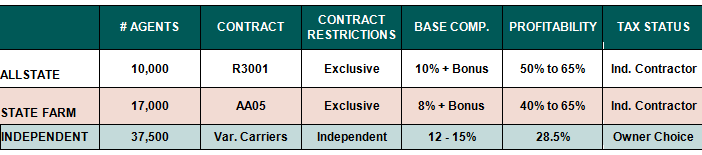

Since my interest was piqued, I took a stab at comparing what I see to be the three main agency ownership opportunities in the market today. The three ownership opportunities are:

· Allstate (10% base)

· State Farm (8% base)

· Independent Agency (15%)

What am I trying to accomplish with this article? Well, after lending $500 Million to over 1,000 Allstate Agents for agency purchases, I have a strong knowledge of the Allstate opportunity. So, I wanted to take this opportunity to learn more about the independent agency and State Farm Agency ownership opportunities. Most importantly though, I wanted to get a feel for which opportunity is the best. And by best I mean the best to me. Certainly, everyone will have their own opinion of which opportunity is the best for them.

My personal expectations for what makes a good ownership opportunity for any business are:

· I want to make money (profit) in step with my efforts

· I want it to be easy to get in and out of the business (easy to start and easy to sell)

· I want the business opportunity to be within the framework of a true entrepreneurial opportunity. My definition of entrepreneurial opportunity is:

- I have the freedom to manage business operations as I see fit

- The business should be an asset on my balance sheet – meaning I can sell it at market value at anytime

- I want the upside potential to be in step with the downside risk associated with owning a business

So, if you are considering entering the Insurance business, and can’t decide which opportunity is right for you, I hope this article helps just a little. If you are currently an Agent with Allstate, State Farm or an Independent Agency owner, I hope this article gives you some comfort or clarification about whether or not the grass is really greener on the other side.

“The views, opinions, positions or strategies expressed by the author and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of AgencyEquity.com.”